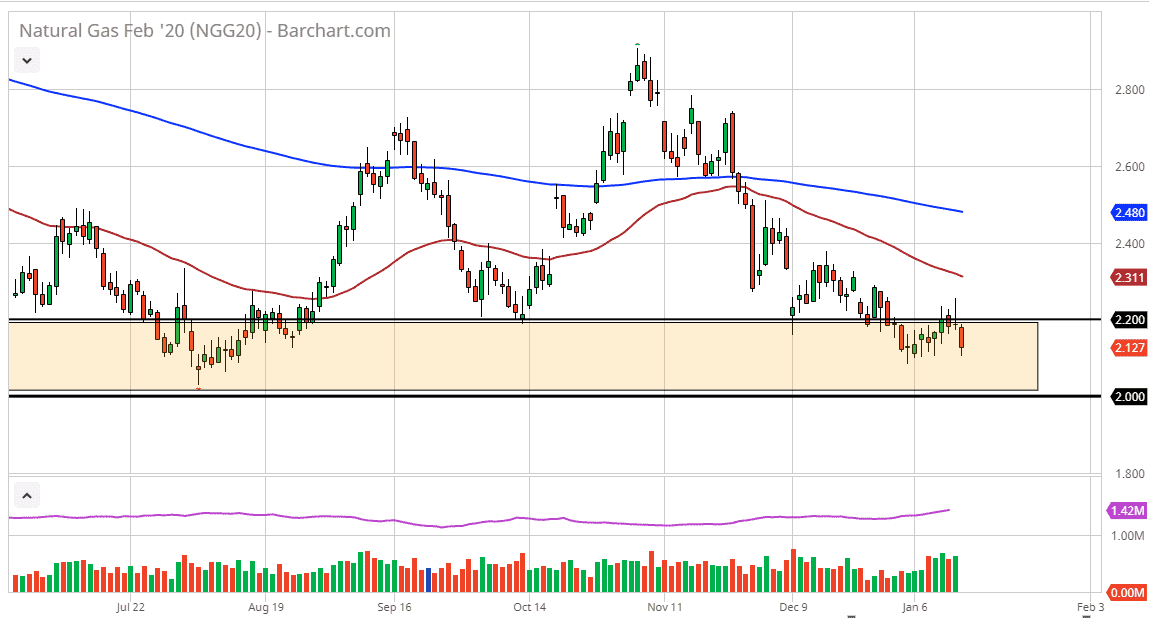

Natural gas markets have pulled back a little bit during the trading session on Wednesday, as the market awaits the inventory figures coming out on Thursday. The market is currently sitting in the support zone that extends down from the $2.20 level to the $2.00 level. Ultimately, this is a market that is at extreme lows, so don’t be surprised at all to see some type of bounce. This will certainly be the case if the inventory number comes out more bullish than anticipated, currently expected to be a reading of -71 billion. That being said though, the market is likely to find value hunters given enough time anyway.

If the market can break above the top of the shooting star from the previous session on Tuesday, then it’s likely that the market goes much higher, perhaps reaching towards the 50 day EMA and then possibly even the $2.40 level. At this point, the market will probably run into a bit of exhaustion and that exhaustion should be taken advantage of. The market has been in a downtrend forever, considering that the Americans have drilled so much over the last year. In fact, production of natural gas has been 17% higher than the previous year, and that of course suggests that the oversupply will continue.

Because of this, and the fact that temperatures remain relatively elevated in the United States, I don’t trust rallies at this point, and it’s obvious that the market has had a horrible winter. Furthermore, if the market is likely to sell off, then I think it’s easier to simply wait for rallies that you can sell into. What I’m hoping for is some type of extremely bullish inventory figure that shoots this market straight up in the air. I am more than willing to sell into that because it is going to take several bullish inventory figures to change the overall attitude of the market. This is a market that could get a significant bounce sooner or later but being patient enough to take advantage of that spike and go in the other direction is probably the only real trade that’s going to be left between now and spring. Speaking of which, Spring is just around the corner and the oversupply of natural gas is going to continue to be a major problem. 2020 is probably going to be horrible for the natural gas markets in general.