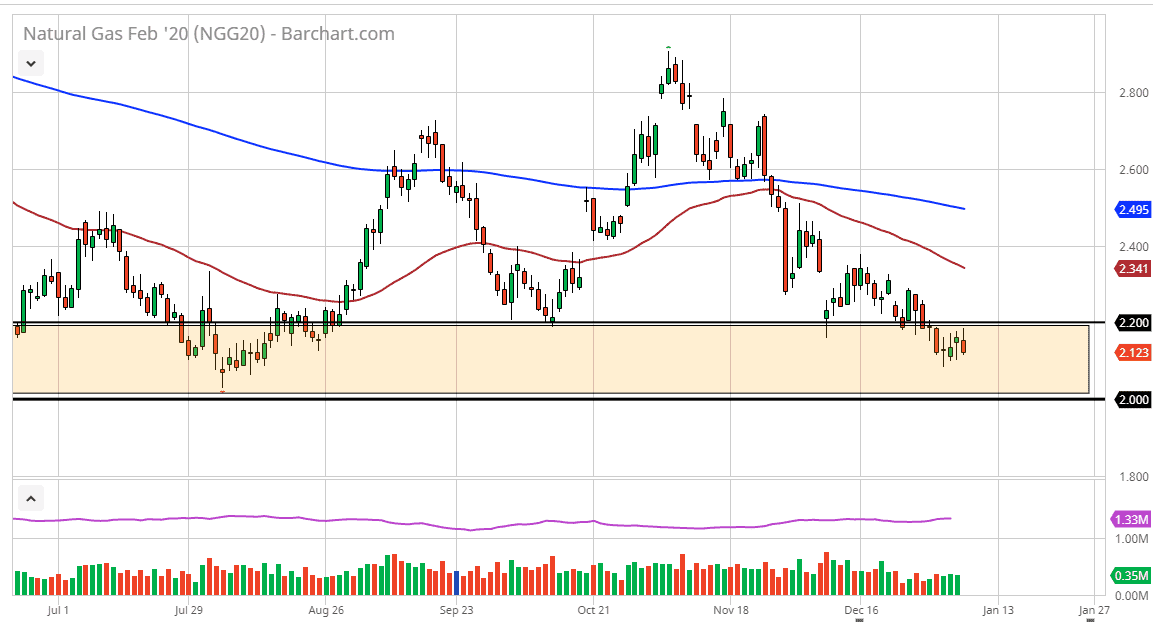

The natural gas markets initially tried to rally during the trading session on Wednesday, reaching towards the $2.20 level before pulling back to show signs of exhaustion. At this point, it looks like we are stuck in a relatively well defined range. Ultimately, I think that this range is going to continue to be an issue, so keep in mind that we will struggle at the $2.20 level to go higher, but if we can break above there it’s likely that the market could go looking towards the $2.30 level, possibly even the 50 day EMA above at the $2.35 level.

Underneath, the $2.00 level should continue to offer plenty of support as it is a large, round, psychologically significant figure, and of course the low that we had seen on a longer-term chart. All things being equal though, this is a market that will be very thick and difficult to trade in this general vicinity. Ultimately though, this is a market that suffering from a major oversupply of natural gas as the Americans have drilled 17% more this year than last. That being the case, it’s going to be very difficult to break out to the upside for any significant amount of time, but if we do then I believe that the 50 day EMA is about as far as this market can go. Quite frankly, it would take some type of major shock to the marketplace to change the overall attitude.

To the downside, I believe that the $2.00 level being broken would be a significant and major breakdown. At that point, it’s hard to tell where the market will go, because quite frankly it would be such a massive disruption this time of year that it would be somewhat unprecedented and erratic. At this point, I think the easiest trade is to simply fade rallies at the first signs of exhaustion, because quite frankly temperatures just have not cooperated in the United States. In fact, in the northeastern part of the United States it’s going to be spring like this weekend. With that, demand for natural gas has been very soft, and marrying that with the oversupply you have a situation where the market simply cannot get up off of the floor. This year has been an absolute disaster for natural gas markets so I suspect that next year will be bunch more bullish when we get to the cold weather because I anticipate that a lot of drilling will suddenly stop later this year.