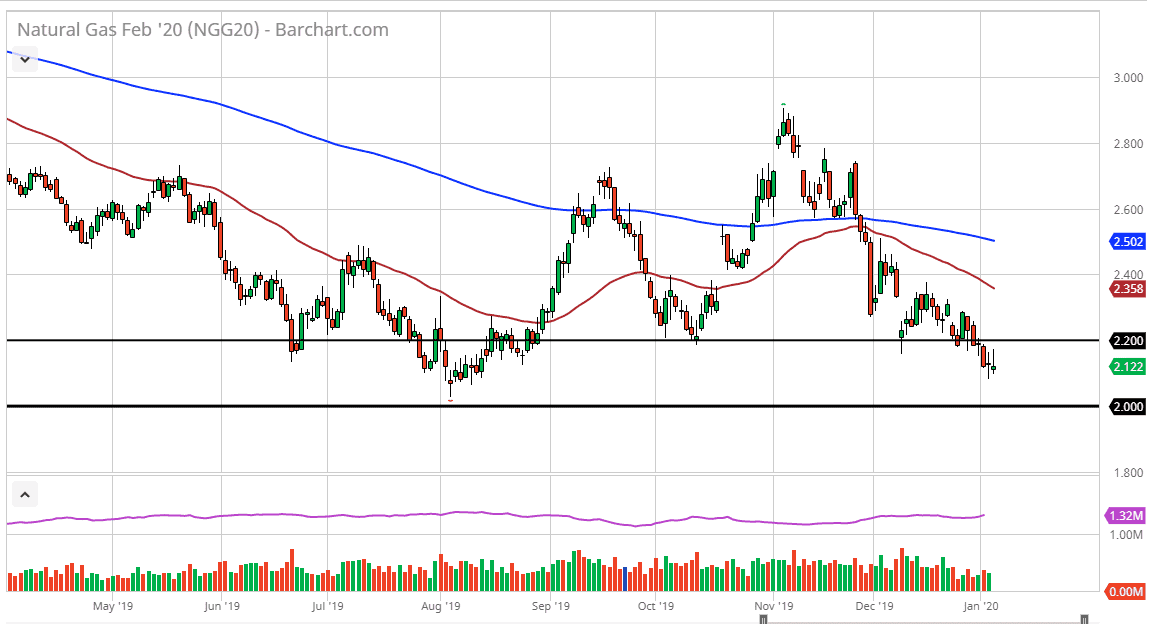

Natural gas markets initially tried to rally during the opening of Monday trading, but the $2.20 level has offered enough resistance to turn things around. That being the case, it looks very likely that we will continue to see a lot of back-and-forth trading. This is a market area between the $2.20 level and the $2.00 level that will continue to be very noisy. Overall, it is a large area that is trying to offer a bit of a “floor” in the market, but quite frankly natural gas markets are dead. Because of this, you will probably see rallies that get faded more than once. Ultimately, the $2.40 level offers a significant amount of selling pressure as the 50 day EMA is in that general vicinity and turning lower.

To the downside I see the $2.00 level as a massive support level. If we were to break down below that level it would be disastrous for the natural gas markets, and quite frankly I can’t rule that out considering everything that I see on this chart. However, after the candlestick that has formed for the trading session on Monday, if we can break above the $2.20 level it would be an extraordinarily strong move. I think it’s simply going to be easier to fade rallies, because here we are in the beginning of January and natural gas can’t get off of the floor. The fact that the Americans have drilled 17% more over the last year than the previous one continues to weigh upon this market. When I look at this chart, the first thing I think is that we are going to have serious problems later this year as demand will drop even further.

There should be a bounce eventually, but that bounce will be short-lived at best. Natural gas producers and peripheral companies are going to get absolutely crushed this year, with bankruptcies down the road just waiting to happen. Eventually, they will stop drilling and the market will bounce but that’s probably a story for next year. As hard as it is to believe, these markets simply cannot recover, despite the fact that we are in the dead of winter. Warmer than usual temperatures have not been a friend to this market either, and therefore the selling will continue to be a major issue when it comes to this market, and quite frankly I would be stunned to see this market recover after what we have seen this winter.