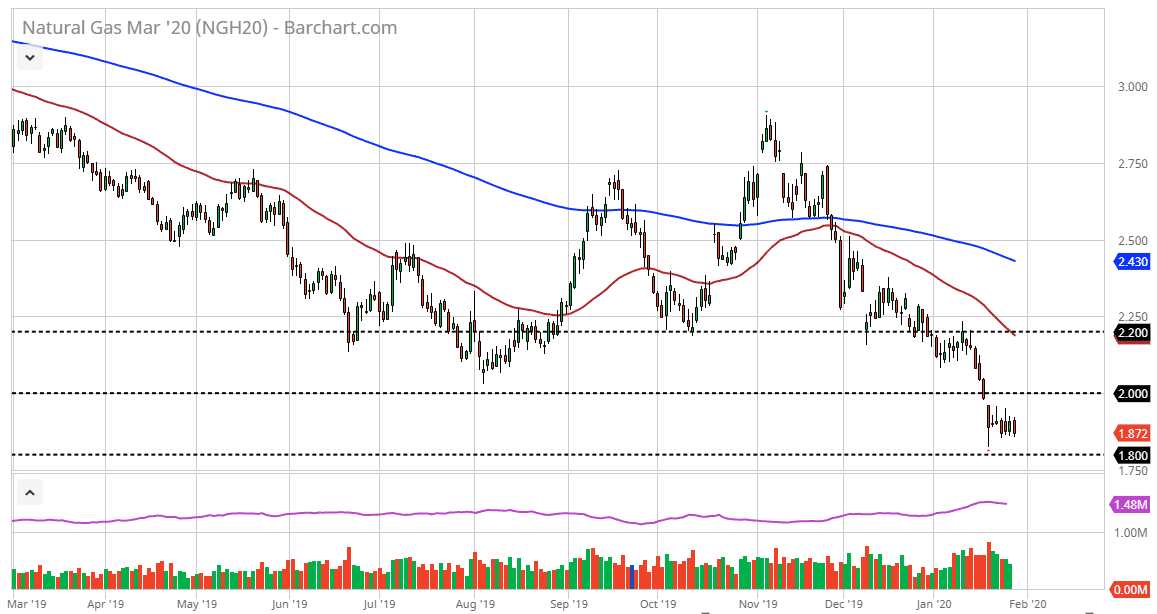

The natural gas markets have fallen during the trading session on Wednesday, as we continue to see this market dance around below the $1.90 level. At this point, it’s obvious that the natural gas market has been a complete bust during the winter, as although in theory you would have more demand coming out the United States and Europe, the reality is that the temperatures have not been cold enough to send this market much higher. With that in mind, I believe that rallies at this point still should look suspicious, and therefore I more than willing to fade short-term rallies that show signs of exhaustion. That being said, I have several prices and levels that I am watching.

The first did most obvious level is the $2.00 level, as it is a large, round, psychologically significant figure. Furthermore, the market likes to trade at these big figures, so it will obviously attract a certain number of sellers just by its very nature. If we can break above there, then the next obvious level is going to be the $2.20 level. I believe that level to be even more resistive as far as potential is concerned. There is also the red 50 day EMA which is sloping lower, and it suggests that we are in fact going to continue to see plenty of reasons for this market to rollover from a technical analysis standpoint.

Furthermore, we are ready starting to look forward to the springtime, and that of course will bring down demand for natural gas in places like the United States and northern Europe. If that’s going to be the case, then obviously demand is going to continue to falter, and that of course is going to drive down the price. That being said, we are probably going to see multiple bankruptcies going forward for those companies that have been flooding the markets with natural gas supply. If that’s the case, then it’s very likely that we would have a very volatile market, and it could rise of quite rapidly. However, so far that has not been the case and it looks very likely that it would be a longer-term process. With that being the situation, we find ourselves and the only thing you can do is fade rallies that are a result of a quick spike, as we are at such historically low levels that is difficult to start selling on breakdowns.