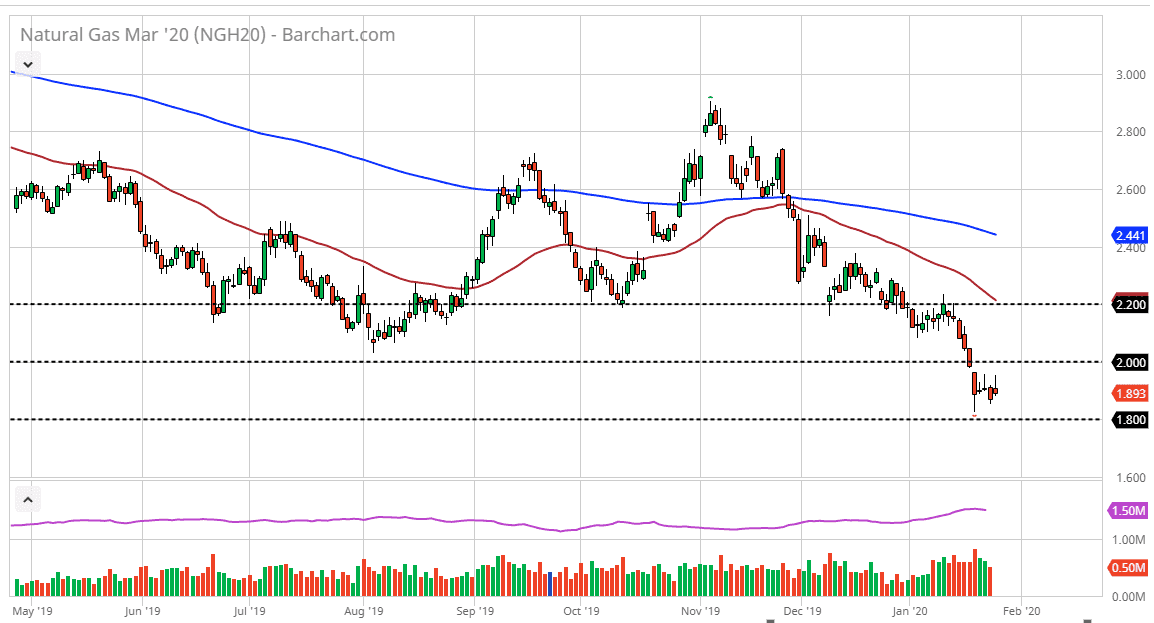

The natural gas markets initially tried to rally during the trading session on Monday but gave back its gains as markets around the world generally were relatively sluggish. The market has been trading right around the $1.90 level, and quite frankly there’s no seemingly strong urge to break in one direction or the other. The $2.00 level above is significant resistance, so we can break above there it’s likely that the market could go looking towards the $2.20 level, which also features the 50 day EMA as well. That’s an area that is not only structurally resistive, but that important 50 day EMA is starting to cross the road. Quite frankly, I think that any move towards that area is an invitation to start selling again.

To the downside, I see the $1.80 level as being massive support, and if we were to break down through there it would of course signal the next leg lower. We are at such low levels that it’s very difficult to imagine that we can simply fall apart from here. That being said, if you look at the market rallying as an opportunity, simply stepping back and looking for some type of spike in the market that shows signs of exhaustion as an opportunity is probably going to be the way to go going forward.

While the time of year is typically very bullish for natural gas, the Americans have drilled 17% more this past year than they did the previous one. Because of this, and the fact that the winter has been relatively mild in the United States, natural gas simply has not been burned off enough to drive prices to the upside like it typically will happen this time year. Furthermore, the natural gas industry needs to see more bankruptcies going forward in order to drive down the production. At this point, the market is likely to see rally sold, and that’s probably the only way you can trade going forward. If the market does in fact break down below the $1.80 level, then it’s likely that the market will drop towards the $1.60 level, although I’m not as comfortable shorting on a break down that I am shorting rallies that show signs of hesitation or exhaustion. Overall, this is a market that should continue to favor the sellers longer-term, at least until we get the supply under control, something that seems to be very unlikely.