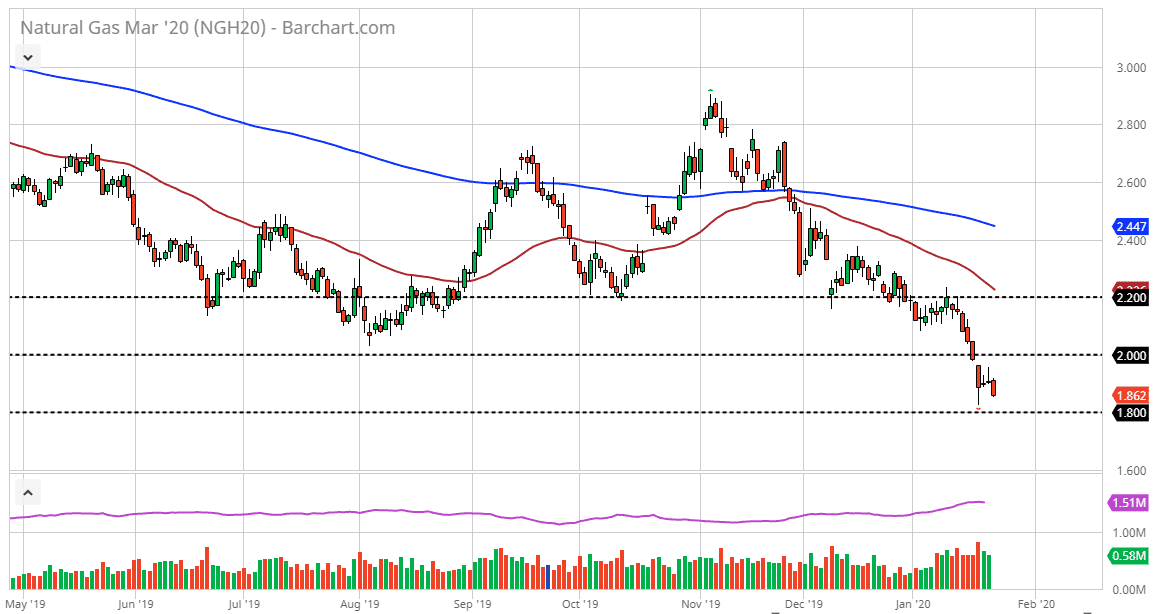

Natural gas markets have fallen again during the trading session on Friday to end a miserable week yet again. At this point though, the market does look as if it is a bit overextended, so I think that it is obvious that we have more bearish pressure, but rallies at this point are probably going to be selling opportunities. Quite frankly, the biggest way that we could turn around the downward trend is to have a new phase of bankruptcies in the US shale companies. Keep in mind that the Americans drilled 17% more during 2019 than they did in 2018, and a market that was already oversupplied.

Ultimately, once we get the bankruptcies necessary, the supply will dwindle, and then the demand can catch up. However, this is a longer-term story so there’s nothing in this chart that suggests that we are going to see a change. I believe that there are major areas of resistance above that will continue to come into play, especially near the $2 level and then again at the $2.20 level. I think that it’s hard to imagine a scenario where we could blow through the $2.20 level, not only due to the fact that it has shown horizontal support and resistance lately, but also the fact that it is the scene of the 50 day EMA currently.

It’s also possible that we could break down below the $1.80 level, but I think it would take a significant amount of momentum to make that happen. If we do break down below that level, it’s likely that the market would go looking towards the $1.75 level, possibly even lower than that. That being said though, I do believe that it’s easier to fade rallies than it is to chase this market to the downside as we have seen so much extreme negativity. All of this being said, if we were to break above the $2.20 level, it would show a major shift in momentum, something that doesn’t look very likely to happen quickly. That being said though, the market is starting to come to grips with the idea that the colder temperatures are coming through this year, at least not enough to destroy the supply. We are not quite ready to turn the turned around, which will take a massive amount of effort to bring about. As this market stands right now, it looks like every $0.20 we have a major reaction.