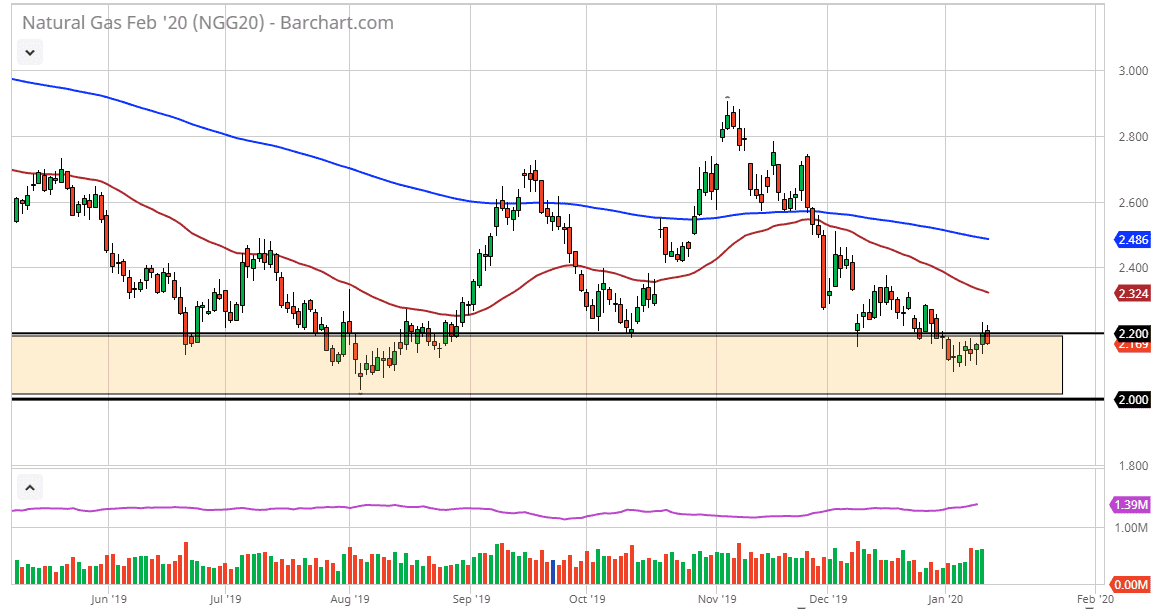

The natural gas markets did pull back just a little bit during the trading session on Monday, as the market started off on the back foot. Ultimately though, this is a market that has a significant amount of support extending from the $2.20 level down to the $2.00 level. Beyond that, it’s only a matter of time before we get some type of significant winter storm in the United States, but we don’t have that on the horizon quite yet. True, there are supposed to be colder temperatures in late January, but it has been so warm this year that it’s difficult to imagine that we will certainly see inventories chewed through anytime soon.

Beyond that, one of the biggest problems that natural gas markets will have is the fact that the Americans drilled 17% more last year than they did the year before and it’s going to take quite a bit of work to use all of that supply up. Furthermore, even if the market did demand more natural gas, there is more than enough out there to continue keeping price lower. Essentially, the market is in a very bad place because it is extraordinarily oversupplied, and even foreign markets will be a bit week as well, as the Russians in the Ukrainian pipeline traffic to Europe has been solidified.

Ultimately, this is a market that I believe will continue to fade rallies, and it will be very interesting to watch in 2020 because we are at such extremely low levels one would have to think that drillers will stop, or at least slow down. That could drive prices up later next year, but in the meantime there’s no real signs of strength, and I just don’t see that changing. Granted, we will probably get some type of significant bounce sooner or later this winter, but that is a bounce that will be sold.

The first place I see significant opportunity for sellers to step in will be the 50 day EMA, which is currently trading around the $2.32 level. After that, the 200 day EMA will likely come into play as well, which is near the $2.48 level. At the first signs of exhaustion after a rally, one would have to think that the sellers will step into crush any type of upward momentum as that trade has worked out so well for so long. I have no interest in buying anymore, quite frankly I’ve given up on that idea.