The NASDAQ 100 has broken down a bit during the trading session on Friday as traders around the world collectively freaked after the Americans killed an Iranian general. That being said though, it’s very unlikely that this will escalate much further. There may be some reaction by the Iranians, but that was a pretty swift and no-nonsense reaction by the American government, much more stringent than usual.

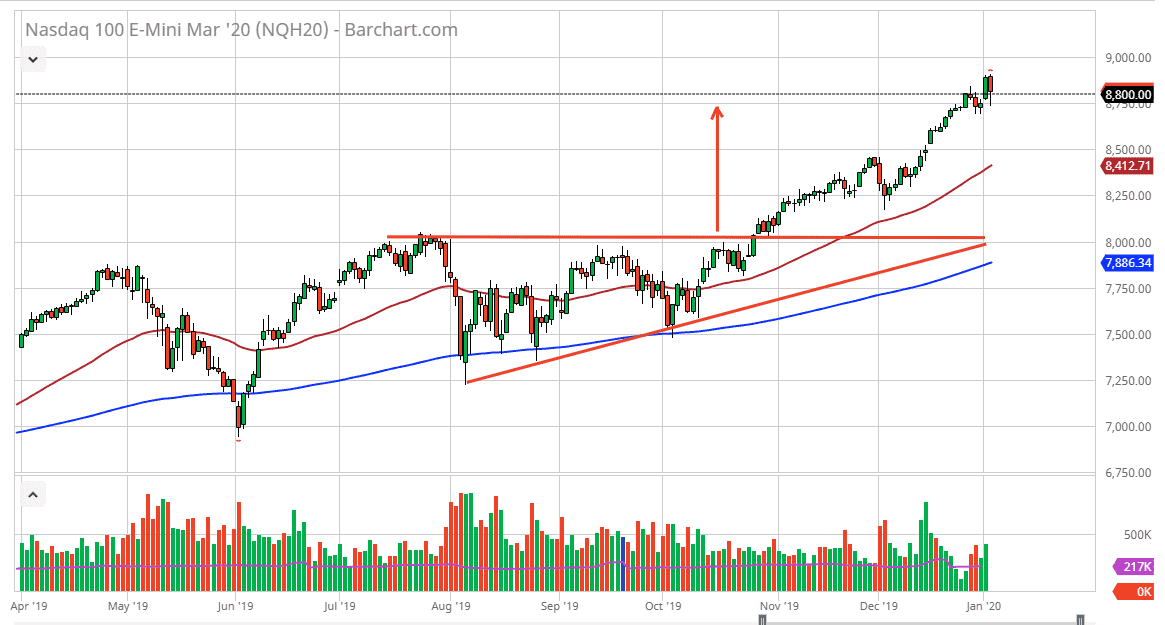

The market did bounce from the psychologically important 8750 level and is closing just above the 8800 level. The 8800 level was a target built based upon the market breaking out above the top of the ascending triangle, measuring the height of that pattern. The 50 day EMA is underneath and turning higher, and as a result it’s likely that we should continue to go much higher. The market is very bullish, and it looks likely to continue being so, especially if the Iranians in the Americans can play nice for a while. The Americans and the Chinese are starting to do so, so that could pile on a lot of risk appetite when it comes to the markets.

Even further down the road, the 8500 level should offer plenty of support as well. I have no interest in shorting this market though as I think that there should be plenty of buying opportunities on these dips. It’s not until we break down below the 8000 level that I would be overly concerned, because it would be such a massive “give back” when it comes to the recent break out. The 200 day EMA is fairly close to the 8000 handle as well, so that is an area that most certainly will attract a lot of attention. All things being equal, it’s very likely that this market continues to go looking towards the 9000 handle, perhaps even the 10,000 level over the longer term. The candlestick is very bullish, so having said that if we were to break down below it becomes a “hanging man”, which of course is a negative sign. However, I think that there is enough support underneath to keep this market going to the upside over the longer term. Obviously though, the 9000 level above is going to be psychologically important and therefore should cause some type of reaction if we do reach towards that area. All things being equal, I do believe that this market will continue to grind away to the upside.