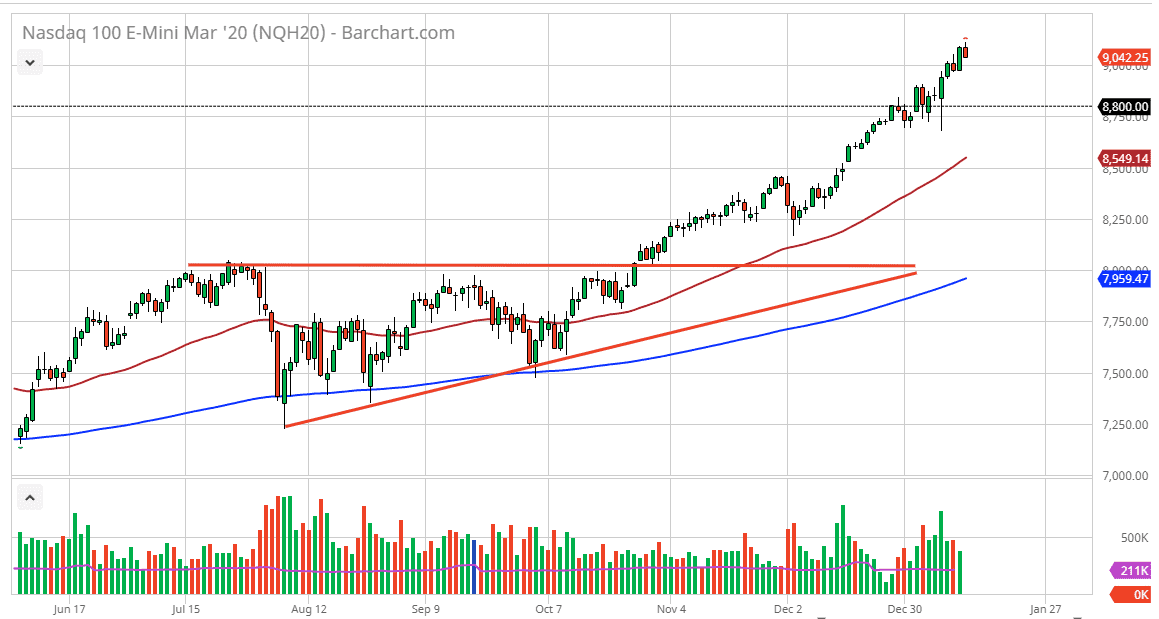

The NASDAQ 100 has initially tried to rally during the trading session on Tuesday but then gave back the gains in order to form a negative candlestick. Ultimately, I think that it’s only a matter of time before the buyers return though, as we have been in such an explosive uptrend. Furthermore, the United States and China are getting ready to sign the “phase 1 deal”, which is going to increase transactions between Beijing and Washington, and that should give a bit of a boost to this index considering so many companies out there on the index have a lot of exposure to both countries.

I like buying pullbacks, because the NASDAQ 100 has plenty of reasons to think that it’s going to continue going higher, and obviously we are in a very strong uptrend. The Federal Reserve will continue to support the markets anyway they can, and of course the 50 day EMA is starting to scream towards the 8600 level. I recognize the 8750 level as significant support, so if we can get a bit of a pullback and the 50 day EMA to reach towards that level, it might be a bit of a “perfect set up.”

If we were to break down below the 50 day EMA, it’s likely that the market probably continues to go a bit lower. If that’s going to be the case, then keep in mind that the market will continue to find plenty of interest at these lower levels, and I think that any type of major selloff will be thought of as a buying opportunity without some type of major fundamental catalyst that suddenly changes. With tensions coming down between the Americans and the Chinese, it’s a bit difficult to imagine that we are going to see a sudden change in overall attitude. That being said, anything’s possible sushi keep that in mind.

To the upside, the 9000 level being broken suggests that we could go as high as 9500 over the next several weeks if not months. I don’t have any interest in shorting this market, I think that looking for value will continue to be the best way to go going forward as it is in most indices involving the Americans. Furthermore, even though we are a bit extended it looks to me like the 8750 level is very solid as far as offering the short term “floor.”