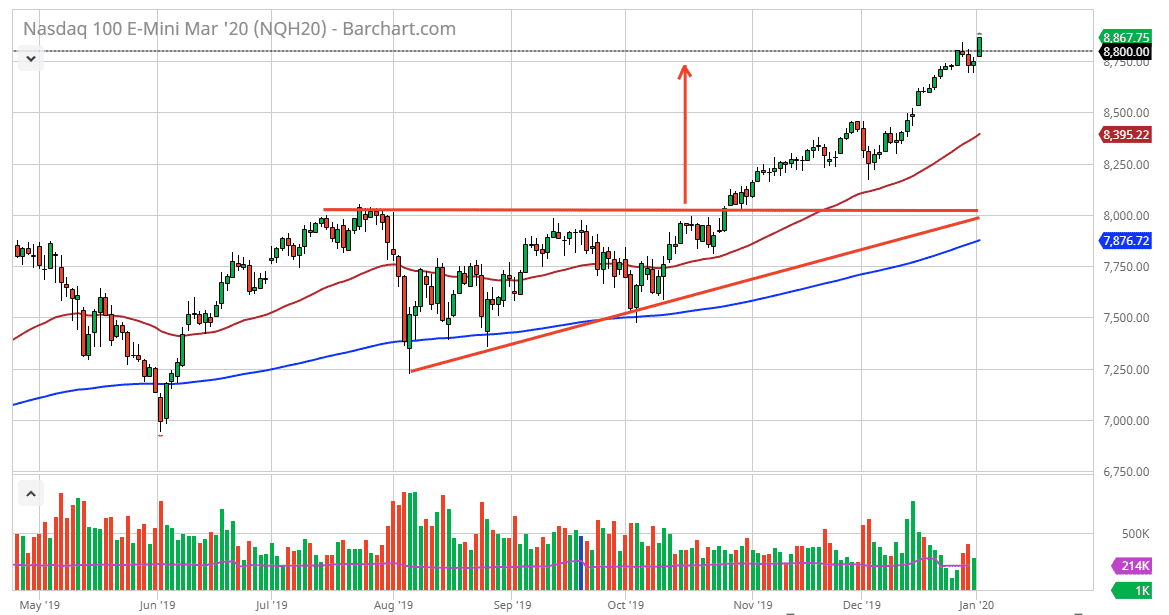

The NASDAQ 100 has broken above the crucial 8800 level during the trading session on Thursday, thereby showing that we are ready to go much higher. Remember, the 8800 level was a target that I had pointed out last year, and we did in fact hit it at the very end of December. This was based upon an ascending triangle that had been broken out above and measured move for that level. Now that we have reached that area and pulled back a bit only to break through the again, I think that the buyers are coming back into take this on.

I like the idea of the market probably going to the 9000 handle, but it doesn’t mean that it gets there overnight. Short-term pullback should be a buying opportunity, and therefore I like the idea of taking advantage of value when it appears. Remember, the NASDAQ 100 is full of companies that do a lot of business between the Americans and the Chinese and therefore the US/China trade situation continues to be a major driver of where the NASDAQ 100 goes next. Because of this, it is going to be extraordinarily sensitive the headlines coming out of either China or Washington DC, but at the end of the day we are in an uptrend anyway.

Trends like this to run for ages, and it looks as if a lot of players starting to come back into the marketplace in order to take advantage of what has been a long term trend. The 50 day EMA is underneath and reaching towards the 8500 level, which also was a scene of significant resistance previously. That should now be support, and once the 50 day EMA gets that level, it should offer massive support due to not only the EMA but also “market memory.” Overall, this is a market that I like picking up based upon value, and therefore don’t have any interest in trying to short this situation. That being the case, I’m only looking to go long and pick up a little bits and pieces along the way. If you are cautious, you can build up a larger core position as well, as this has been such a great performing asset over the last several months. 9000 will of course cause a certain amount of psychological resistance, so I think it will take a lot of work to get through there.