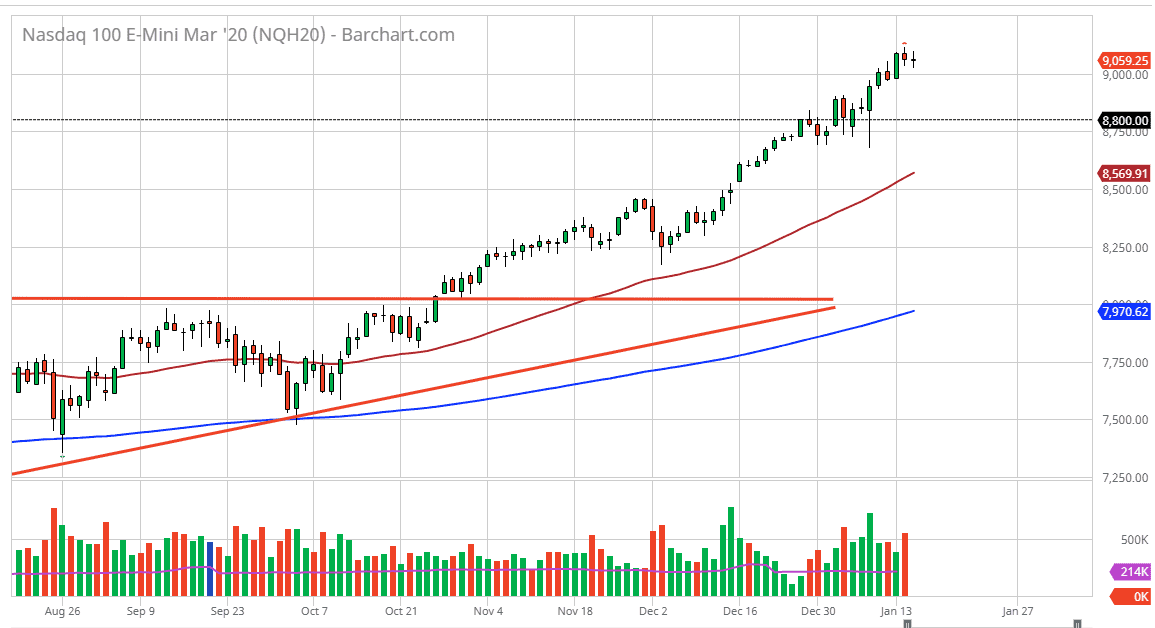

The NASDAQ 100 has gone back and forth during the trading session on Wednesday, showing signs of lackluster trading. That’s not a huge surprise, because we already knew about the US/China trade situation, and that the market had already priced in the move. At this point, if the market was the pullback from here it’s likely that the 8800 level would be a bit of support. Furthermore, if we were to break down below the 8750 level, then we could get a more significant pullback.

Ultimately, if we just breakout above the highs from the previous session on Tuesday, then it’s likely that we will go looking towards 9500 level. Either way, I believe that the NASDAQ 100 is going to be a market that continues to go higher, because both countries do a lot of business with the companies on this index. Ultimately, we are a bit overextended, so I think it’s only a matter of time before people take advantage of value as it appears. I also recognize that the 50 day EMA should continue to grind higher, and that is essentially the “moving floor” in the market.

I think we go looking towards the 10,000 level but that is probably a story for later in the year. If we were to break down below the 8500 level, then the trend will have changed. I don’t think it’s going to happen anytime soon, but it is something to keep in the back of your mind. Ultimately, this is a market that has the attention of buyers, and therefore we continue to see what the case has been for so long. Furthermore, we have the Federal Reserve out there looking to keep the markets afloat, and I believe that a lot of the traders out there continue to bank on that as a fact. Ultimately, the market has traded over the last decade based upon what the Federal Reserve is doing, not necessarily what the companies out there are doing. It’s all about liquidity, and whether or not the Federal Reserve is to continue offering as much as they can. Jerome Powell has in the last year has shown that he has a proclivity to do whatever he can to keep the stock market afloat, as the Federal Reserve is now the back pocket of Wall Street. Sad, but true. Even if we do get a significant pullback, stepping on the sidelines and looking for a buying opportunity, barring some type of financial meltdown, is the way to go.