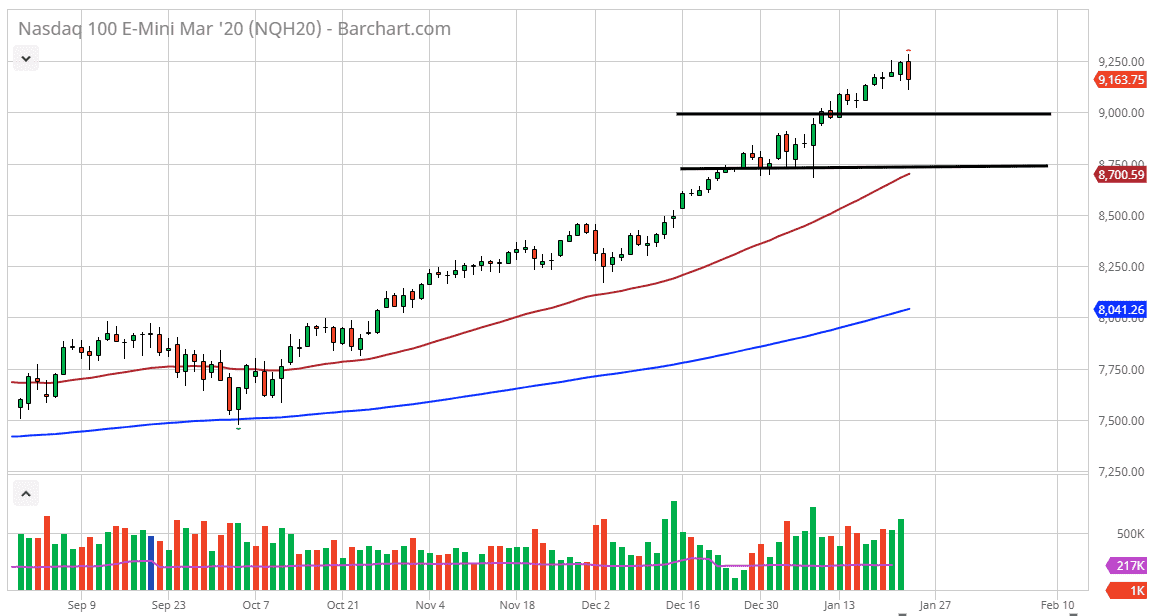

The NASDAQ 100 has broken down after initially trying to rally on Friday, showing the 9250 level to be far too resistive. At this point, I believe that the market is likely to go looking towards support underneath, possibly even as low as the 9000 level. Furthermore, the 8750 level features the 50 day EMA crashing towards it. With that in mind it’s likely that we will see buyers sooner or later and it’s also worth noting that the central banks around the world will continue to loosen monetary policy or at the very least add to balance sheets.

The alternate scenario is that we go sideways to kill time, as we have rallied so significantly over the last couple of months. At this point, I think that it would be even better if we do pull back to the 9000 handle but quite frankly, I think we may not get that. Either way, I like the idea of buying dips as it offers value as this is a market that is obviously a very bullish you should not want to short that overall trend. Ultimately, we need some type of reason to break down, but I also like the idea of killing time as an opportunity for people to get used to the idea of being this high in value.

All things being equal, I have no interest in shorting this market until we break down below the 50 day EMA, something that we are nowhere near doing right now. The attitude of the market continues to be one that trusts the Federal Reserve to keep it afloat, and the NASDAQ 100 has the added benefit of a potential easing of trade tensions between the Americans and the Chinese. Regardless of the reasoning, it’s obviously a market that the bullish and therefore you don’t want to try to go against this trend. It’s obvious that we are a long way from turning the trend around, so you need to look at this through the prism of the larger traders out there, that pullbacks offer plenty of value that you can take advantage of. It’s essentially “going on sale” when we do pull back. I think ultimately, we probably go looking towards the 10,000 level by the end of the year but obviously we probably won’t be straight up in the air like we were for so long last year.