The NASDAQ 100 has done very little during the Monday session in the electronic markets, as the underlying index certainly wasn’t open due to the Martin Luther King Jr. holiday in the United States. Ultimately, this is a market that is bullish though and that’s the only thing that you should pay attention to. The market is a bit stretched, but it should continue to offer value on pullbacks.

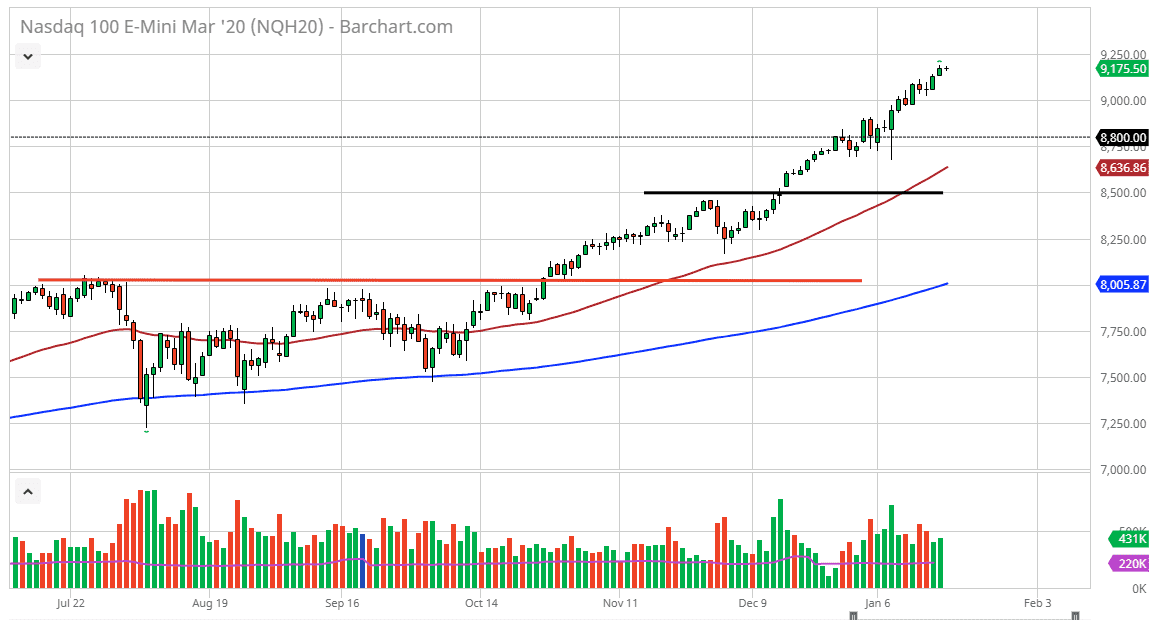

The 8800 level was a crucial level based upon the previous ascending triangle, and now that we have broken above the target and then retested it for support, it’s likely that the markets will continue. The 9000 level is one of the most obvious levels that traders will pay attention to, as it is a large, round, psychologically significant figure in of course an area where we have seen the most recent surge from. To the downside, the 8800 level will of course come back into play and then the 50 day EMA after that. This is a market that is extraordinarily bullish, but it is also a little bit overdone.

The NASDAQ 100 is sensitive to the US/China trade situation that of course comes into play, as we have recently had the “phase 1 deal” sign, and that of course is crucial. That being said, I look at pullbacks as an invitation to start buying the NASDAQ 100 again, and of course you can’t read too much into the neutral candlestick for Monday. The move on Thursday and Friday will was relatively strong, but since we had pulled back to the 8800 level and had that surge nine sessions ago, we have not had a significant pullback. It does make sense that we get a little bit of a pullback that we can take advantage of. That being said, if we break above the 9250 level, then the market is ready to continue going higher.

Longer-term, I believe that this market is probably going to go looking towards the 10,000 handle, which is an area that should offer a lot of psychological resistance, and of course I believe will be a target for longer-term traders. By the end of the year, it might possibly be the in target, but we are going to go straight up in the air like that. I believe that this year will be bullish, but maybe not quite as bullish as the year before.