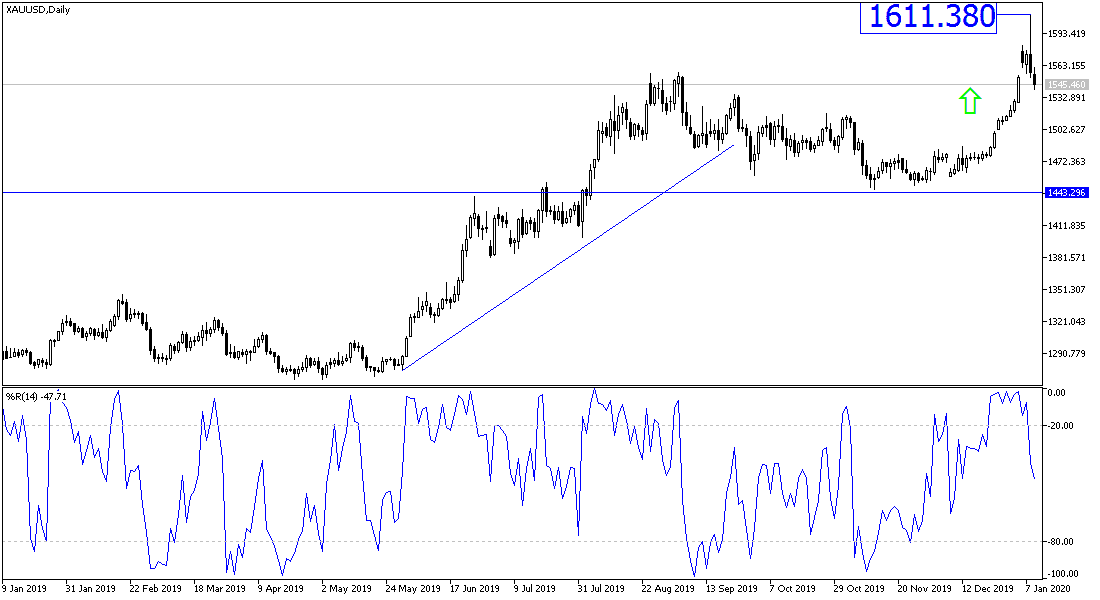

Despite the decline in Gold prices by more than 70 dollars, down to the $1540 level an ounce after record gains at the beginning of yesterday's session, pushing it to the $1612 resistance, its highest level in seven years, the trend is still bullish. The loss of these gains was supported by the appeasement statements by US President Trump on the missile attack by Iran on US bases in response to the US killing Qasim Soleimani, a prominent Iranian military commander, accused by the Trump administration of being primary responsible for harming American interests in the region.

Trump revealed in a speech to the nation that his administration will impose additional economic sanctions on Iran after it launched an attack on Iraqi military bases that includes US forces. The new sanctions are likely to have a negative impact on the Iranian economy, which is already suffering, but it appears to be much less than Trump's previous threat to "strike them with more force than they have seen before!"

It appears that Trump's decision to abandon the military response to the Iranian attack stems from the fact that the Iranian missile attack did not result in a loss of American or Iraqi lives.

Trump continued his attack on the Iranian nuclear deal reached during the era of former President Barack Obama, claiming that Iran used the funds released by the deal to embark on a "wave of terrorism". "Iran must abandon its nuclear ambitions and end its support for terrorism," Trump said. "It is time for the United Kingdom, Germany, France, Russia and China to recognize this reality."

On the economic level. The ADP survey reported that US companies succeeded in employing a total of 202000 new jobs, more than expectation of 160,000 new jobs. Previously, the survey saw 67,000 jobs in November. The result is a good impression of the US Labor Department report tomorrow, with expectations indicating that the US economy may succeed in providing 150,000, which is less than 266,000 recorded in the month of November.

According to the technical analysis of gold: Despite the recent rebound in the price of gold, it is still in the range of a bullish channel, supported by its stability above the $15000 psychological resistance, and there will be no real reversing of this trend without moving below this level. At the present time, the closest support levels for gold are 1538, 1525 and 1515, respectively. Renewed global geopolitical tensions are still flammable at any time, and therefore provides strong support for gold prices as one of the most important safe havens for investors in times of uncertainty as is the current situation.