Limited optimism in the performance of global financial markets, especially stocks, contributed to the decline in gold prices to the $1563 level. After the announcement of monetary policy decisions from the U.S Federal Reserve Bank, the price of the US dollar declined, so gold found the opportunity to rise again to the $1578 level in the beginning of Thursday’s trading. All eyes of the world are on the results of the emergency meeting of the World Health Organization, in which the implications of the Corona virus and its global spread are discussed.

The US central bank kept the interest rate at 1.75% unchanged, as was strongly expected from the markets, and the bank stressed its adherence to its policy as long as the country's economic performance is constantly improving. Bank Governor Jerome Powell indicated in his press conference to monitor the repercussions of the Corona Virus on the global economy and, consequently, on the US economy, to take action if things worsened.

Despite the bank’s decision, investors seem to increasingly believe that the Fed will feel compelled to cut interest rates again later this year. The odds of a cut in the Fed meeting in September have risen to about 56%, according to FedWatch, which is up from 37% Just a month ago.

Many economists and investors had hoped that U.S and global growth would rise this year, especially after the United States and China signed a preliminary trade agreement that removed some tariffs of Chinese goods. In the same context, the International Monetary Fund said last week that lower interest rates and easing trade tensions are likely to boost the global economy over the next two years and help boost steady growth, even if it was a modest one.

But the Coronavirus outbreak in China has raised new doubts. And more negative consequences of the virus will slow the Chinese economy - the second largest in the world - which has already started to slow down. The virus has now infected more people in China SARS ddi in 2002-2003.

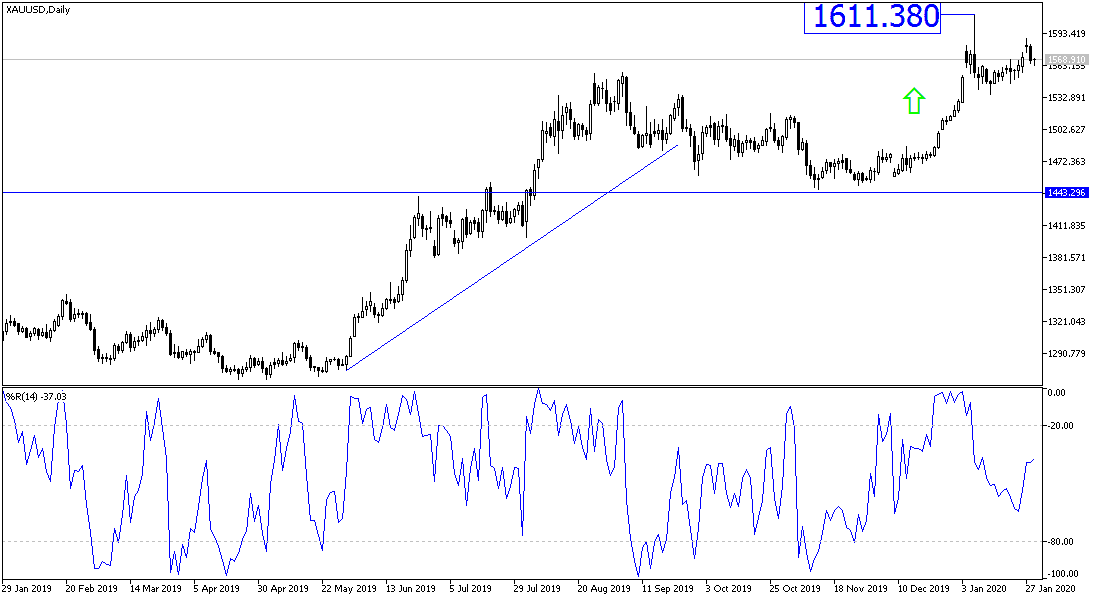

According to the technical analysis of gold: On the daily chart, gold prices are still moving inside an ascending channel, and the persistence of global tensions from the Corona virus may support more gains for the yellow metal, and bulls are still aiming to push prices to the $1611 psychological resistance, the highest level for seven years, and even breaking through it. On the downside, the closest support levels for gold prices are now 1568, 1555 and 1540, respectively.

As for the economic calendar data today: Gold prices will interact with the Bank of England's announcement of its monetary policy, and then the US economic growth rate for the last quarter of 2019.