Gold prices returned to decline to the $1563 level after recent gains, which reached the $1588 resistance as a result of strong investor appetite for the yellow metal as a safe haven, due to the outbreak of the Corona virus in the second largest economy in the world, and then spreading to 10 other countries, with infections and spread continues as no announcement was made yet that the position is contained. The recent decline in the gold prices was due to profit-taking sales. There has not yet been a shift in the general trend, as it is still bullish. Reassurance came after a report being circulated by Xinhua News Agency, quoting a Chinese respiratory scientist who believed that the Corona virus could be eliminated within one week or about 10 days. But this would not give global financial markets full confidence without the formal announcement of the eradication of the virus and the return to normality in China. The yellow metal is an ideal safe haven for investors in times of uncertainty.

China has so far confirmed more than 4,500 cases of coronavirus and more than 100 deaths. The Chinese government closed Wuhan and 16 other cities in Hubei Province, isolating more than 50 million people. On Tuesday, the United States and other countries prepared to fly their citizens out of Wuhan. The spread of the disease has resulted in daily work stoppages and the closure of popular tourist attractions such as the former Imperial Palace in Beijing, Shanghai Disneyland, Hong Kong Disneyland and the city's ocean park.

For economic news. An increase in US durable goods orders was announced, after strong losses in the previous release. The US Consumer Confidence Index rose to a reading of 131.6 this month, up from 128.2 in December. Commenting on the results, Lyn Franco, Senior Director of Economic Indicators at the Conference Board, the body that issued the statement, saying the increase, which followed more moderate progress in December, reflects a more positive assessment of the current job market and an optimism about future job opportunities. “Optimism about the job market should continue to boost confidence in the short term, and as a result, consumers will continue to drive growth and prevent the economy from slowing down in early 2020,” Franco added. Consumer confidence questionnaires are closely watched for clues as to whether households are in the mood of a purchase, as consumer spending represents 70% of the economic activity of the United States of America.

The US economy slowed in 2019 and is expected to slow further in 2020, but strong consumer spending is expected to drive the country away from the brink of recession.

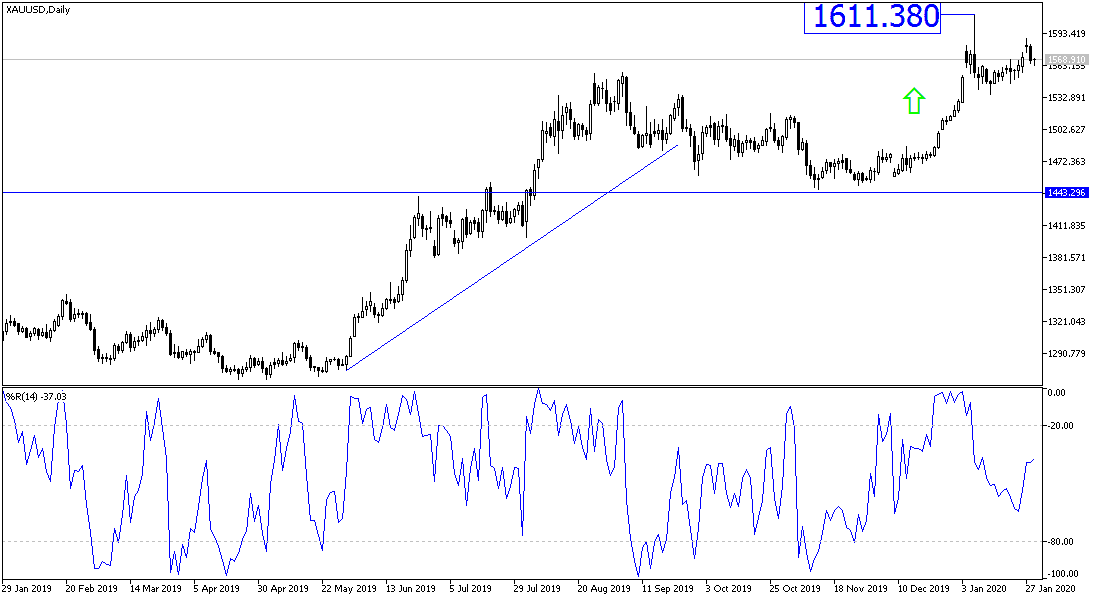

According to the technical analysis of gold prices: On the daily chart, the price of gold is still in the range of a bullish channel, and after the last correction, the closest support levels are currently at 1560, 1548 and 1535 respectively. I still prefer buying gold from every low level, as the situation in China still worries the Global finance markets and threatens global economic growth, which is a fertile soil for gold to achieve more gains as one of the most important safe havens. For the bulls, the 1611 resistance remains a target, moving to it and overcoming it may support the exacerbation of the risks from the Corona virus.

The gold price will react today with the announcement of the US Federal Reserve Bank of its monetary policy and the content of its monetary policy statement and the statements of the Governor Jerome Powell at his press conference.

All focus will be on the US session data, with the announcement of pending US home sales, then the Federal Reserve's monetary policy decisions and the statements of its Governor Jerome Powell.