In the beginning of trading this week, gold prices moved strongly towards the top, recording the $1588 resistance, the highest level in more than two weeks, before stabilizing around $1580 at the time of writing. The demand for gold remains strong as long as concerns about the impact of the Corona virus on global economic growth persist. The death toll from the virus has risen to 81 according to the latest official statistics, and the numbers can increase around the clock.

The spread of the disease is monitored worldwide, with a few cases emerging in other countries. South Korea confirmed its fourth case on Monday. Cases have also been confirmed in Thailand, Taiwan, Japan, the United States, Vietnam, Singapore, Malaysia, Nepal, France, Canada, and Australia.

American cases are found in Washington State, Chicago, Southern California and Arizona.

In addition to monitoring the developments of the Corona virus. Gold prices will react to the Federal Reserve's monetary policy announcement this week. Jerome Powell, Chairman of the Board of Directors, expressed his gratitude for the Fed policy, thanks to the continued strength of the economy, which is driven by a strong labor market. As the country's unemployment rate is at its lowest level in 50 years. Economic growth will remain strong, even if it is modest, at an annual rate of approximately 2%. With low inflation, the bank may therefore sticks to its monetary policy for several months to come.

Last year, the Federal Reserve cut the key interest rate three times after raising it four times in 2018. Powell and other US central bank officials attributed those interest rate cuts to revitalizing the housing market, which had stalled early last year, compensating some economic stagnation due to US President Donald Trump's trade war with China.

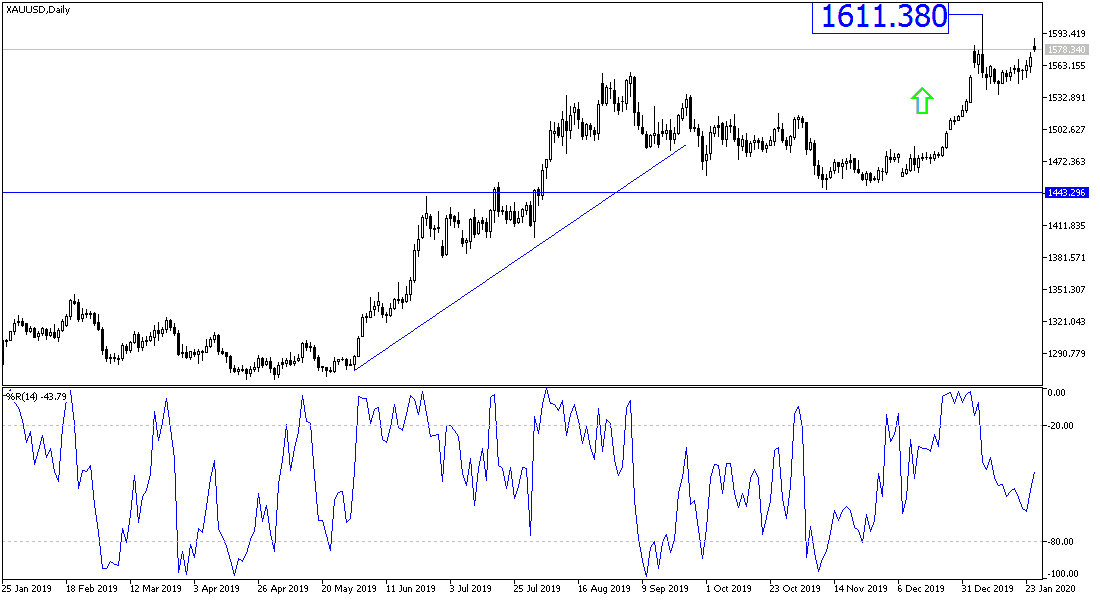

According to the technical analysis of gold: On the daily graph below, gold prices are still in an upward direction, and the $1611 resistance, reached at the beginning of January, and the highest for more than seven years, might be the next target of the bulls. Gold prices may exceed that peak if it was officially announced that the Corona virus is a global epidemic that calls for joint global efforts to stop it. Despite the current situation, gold prices have reached overbought areas, and in the event of confidence returning to global markets, we may witness strong sales to collect profit. The closest support levels for gold prices are now at 1575, 1560 and 1545, respectively. I still prefer to buy gold from every bearish level.

Gold will interact with the corona virus developments and the announcement of US economic releases today, including durable goods orders and the US consumer confidence index.