Gold prices witnessed fluctuation in performance during yesterday's session between the $1569 resistance and a rapid decline, reaching to the $1546 level of an ounce, but the price returned to stability around the $1560 resistance, after concern that prevailed in the global financial markets from the rapid spread of the Corona virus in China and the announcement of 6 deaths so far, and the number is likely to increase, despite the Chinese government's measures. China is an important market for the yellow metal, and at the same time, gold is extremely sensitive to renewed global trade and geopolitical tensions and an ideal safe haven for investors in times of uncertainty.

All global stock markets witnessed a decline amid fears of the worst from the crisis in China, just days after the optimism that followed the country’s signing of the Phase 1 trade agreement with the United States of America, which temporarily halted the tariff war between them, a conflict that contributed to the global economic slowdown and pushed it to the brink of recession if the conflict continues.

China’s National Health Agency said that six people have died and 291 infected with the virus in China. Therefore, a number of countries have already adopted screening procedures for travelers from China, especially those arriving from Wuhan, because of fears of a global disease outbreak similar to SARS, another corona virus that spread from China to more than 10 countries in the year 2002-2003. Chinese health experts have confirmed that it can be transmitted between humans. As the country prepares for the Chinese New Year celebrations, which will start this weekend, which may affect nearly 300 million people traveling within China, greatly reducing this number will remove an enormous annual stimulus to the Chinese economy.

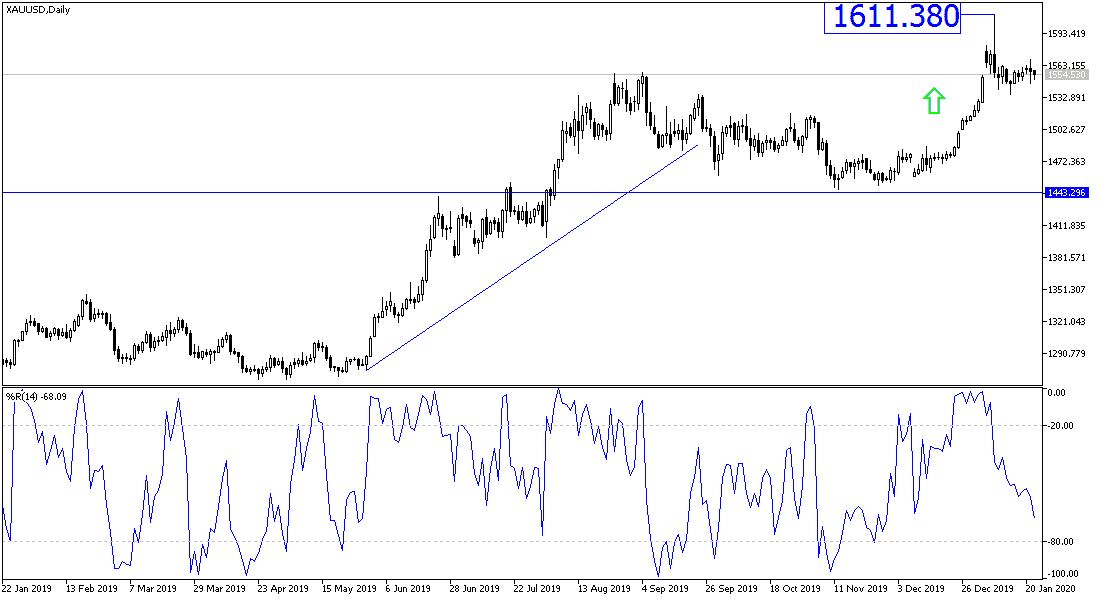

According to the technical analysis of gold: On the daily chart, gold prices are still in the range of an ascending channel and an increase in global market turmoil will support price push towards more gains, the closest ones are at 1566 and 1575, and the following psychological resistance at $1,600, respectively. It is necessary to take into consideration at the same time that the technical indicators are in a an overbought range, and in case of optimism again, the gold prices will collapse strongly. In general, the closest support levels for the pair are currently at 1549, 1535 and 1520, respectively.

Gold will react today with the Bank of Canada's announcement of its monetary policy and the announcement of existing US home sales.