Gold prices continue the bullish correction, but with limited gains. In the morning trading today, Tuesday, the price of an ounce of gold rose to the $1568 resistance before stabilizing around $1562 at the time of writing. Gold has gained momentum from renewed global geopolitical tensions, this was after more than 100 people were killed and dozens were wounded in a missile and drones attack blamed on the Houthi militia in central Yemen. As well as buying before the Chinese New Year has also provided some support for the yellow metal.

The missile attack was reported to have targeted a mosque inside a military training camp during evening prayers on Saturday. The internationally recognized Yemeni government condemned the attack as "a coward and terrorist attack" according to the official Saba news agency. In this regard, Yemeni President Abd Rabbu Mansour Hadi told the army that he is on high alert and ready to battle. He blamed the Houthi rebels, who are backed by Iran, for the deadly attack.

The US dollar remained stable despite the US holiday and the absence of important economic releases from there for the second straight day.

Investors bought the dollar last week after the US inflation rate remained higher than the Fed's 2% target level in December, along with bullish surprises for the year-end retail sales figures that reviewed market pessimism about the US economic outlook. Market speculation was further encouraged after the formal signing of the "Phase 1" agreement last week, which calls for an end to the tariff war between the United States and China.

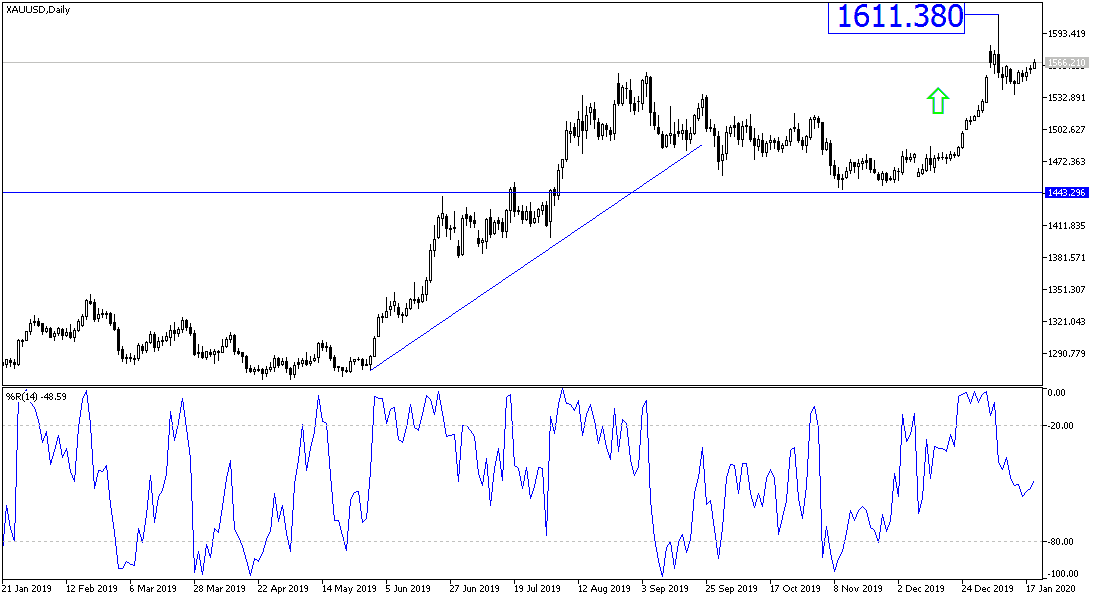

According to the technical analysis of gold: There is no change in my technical view of gold prices, as the general trend is still upward and open for more momentum to test higher peaks. All will depend on the dollar performance in Forex markets, in addition to the renewal or not of the global geopolitical tensions, which usually strongly influences the trends of gold prices. At the present time the closest resistance levels to the yellow metal are at 1572 and 1585 and the following psychological resistance at 1600, respectively. On the downside, the closest support levels for gold prices are 1555, 1542 and 1535 and the last level breaks the trend and starts the started. We still prefer to buy gold from every downtrend level.

Gold will react today with the announcement of the Bank of Japan's monetary policy, job and wage numbers from the U.K and the German ZEW index, and there are no significant US data for the second day in a row.