A corrective performance of the yellow metal recently pushed prices to the $1536 level of, and before the important event today, prices rebounded to the $1554 level an ounce at the time of writing the analysis. Today, during a special ceremony at the White House, U.S President Trump will sign with Chinese officials the Phase 1 trade agreement to stop the tariff war between the two largest economies in the world, which weakened the global economic performance, and led central banks subsequently eased their monetary policies. Before the long-awaited event by financial markets, China welcomed a U.S decision to drop it from the list of governments accused of manipulating the value of their currencies to gain an unfair trade advantage.

Yesterday's customs data showed exports to the United States fell 12.5% compared to 2018 to $418.5 billion, after President Donald Trump's tariffs on Chinese goods increased. December sales to the U.S market shrank by 14.5% from the previous year to $34.4 billion, despite the interim deal and the suspension of further tariffs.

However, the impact of the Trump administration's ongoing tariff hikes to combat Beijing's technological ambitions and trade surplus, was smaller than expected, as American exports to China decreased. Investors hope that the initial agreement to be signed today in Washington will be a step towards ending the conflict that threatens global economic growth.

Under the Phase 1 agreement, which the two sides reached in mid-December, the US administration abandoned plans to impose customs duties on an additional 160 billion dollars in Chinese imports. The current tariff halved to 7.5%, valued at $110 billion of Chinese imports. For its part, Beijing agreed to a significant increase in its purchases of American products. According to the Trump administration, China will buy $40 billion annually in US agricultural products - an ambitious goal for a country that has never imported more than $26 billion annually in U.S. agricultural products.

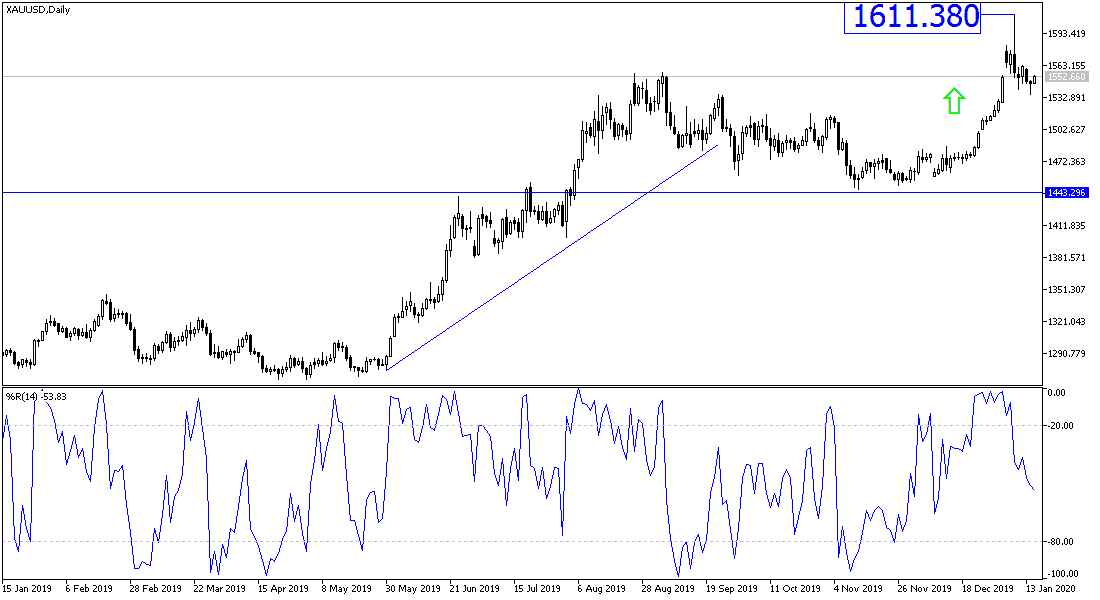

According to the technical analysis of gold: Despite the recent performance, the general trend of gold remains upward as long as it remains stable above the $1500 psychological resistance, and if encouraging details were announced from the agreement between the United States and China today, the price of gold may be subject to some downward pressure, with the closest levels of support for gold are currently at 1544, 1532 and 1520. We still prefer to buy gold from every downside level. The bulls’ current goals revolve around 1562 and 1575 resistance, and the next psychological high at 1,600, respectively. The geopolitical tensions in the Middle East region stopped, but did not end.

As for the economic calendar data: The gold price will interact with the announcement of inflation figures from the U.K and the producer price index from the U.S.