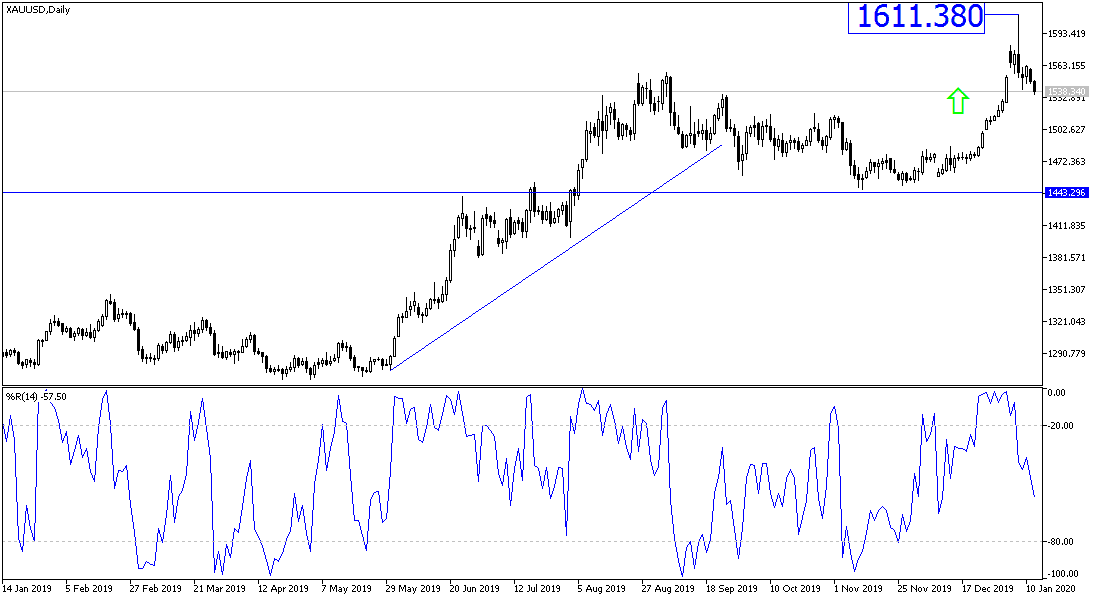

We expected before the beginning of this week’s transactions that gold prices may lose more of their gains with optimism in the financial markets and investors from the imminent date of the formal signing of the Phase 1 agreement between the U.S and China, which stopped, even temporarily, the tariff war between the two, and which has always increased the flight of investors to buy more gold to counter the continued slowdown in global economic growth. The price of the yellow metal fell to the $1536 level, and since the Friday’s trading, we recommend selling gold from the $1566 resistance, but the performance could not recommend the activation until now, which confirms the strength of that specific level. Gold lost its gains during yesterday's session to the $1561 resistance, with the announcement of British economy’s growth contraction to its lowest since 2012.

Calm global trade and political tensions will not be in favor of continuing gold price gains.

Optimism increased ahead of the formal signing of the agreement between the U.S and China after steps recently approved by the two parties. The American administration expanded the scope of the talks by resuming work on the resumption of the semi-annual talks on economic and trade issues. These discussions were held in the previous US administrations but were stopped by the Trump administration. Also, the US administration announced its abandonment of naming China as a currency manipulator before the signing ceremony scheduled for tomorrow at the White House.

On the economic front today. Customs data showed today, Tuesday, exports to the United States fell 12.5% compared to 2018 to $418.5 billion, after President Donald Trump's tariffs on Chinese goods increased. December sales to the US market shrank by 14.5% from the previous year to $34.4 billion despite interim agreement and conciliatory comments from both sides. The effect of the US tariff increase on Beijing's technology ambitions and trade surplus was less than expected.

Apart from the United States of America, Chinese sales increased to Asia, Europe and Africa. China recorded double-digit gains in 2019 exports to France, Canada, Australia, Brazil and Southeast Asia.

According to the technical analysis of gold: Despite the recent trading sessions in which gold prices retreated from their recent record gains, which are the highest for seven years, the general trend of the yellow metal will remain bullish as long as it is stable above the $1500 psychological resistance, and there will be no break of this trend without stability below this the level. At the present time, the closest levels of support for gold are 1535, 1520 and 1505, respectively. And the power of gold will not return again without renewed global trade and geopolitical tensions.

As for the economic calendar data today: All focus will be on announcing China's trade balance and US inflation figures with the release of the consumer price index.