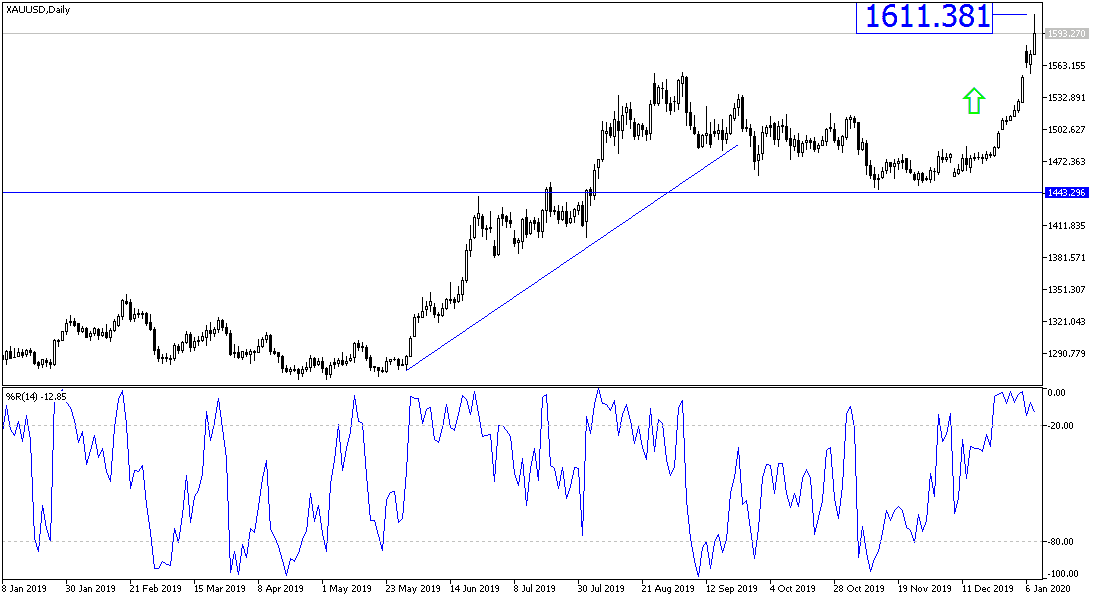

Technical expectations for the future of gold prices have increased recently to move towards new record and historical levels, in case things get worse in the Middle East region, and things turned into a war there, after the tone of the recent threats between the United States and Iran, after an American air strike that targeted and killed the prominent Iranian military leader Qassem Soleimani and his companions in Iraq. In the beginning of this week’s trading, an upward price gap in the price of gold occurred, anticipating the $1582 resistance level, the highest level in more than six years. With fears subsiding, the decline returned to the $1555 level. The increase in purchases in preparation for the expected revenge, pushed the yellow metal towards the $1573 resistance. Prices are settled around that level at the time of writing.

Gold gains ignored the improvement in inflation figures in the Eurozone to its highest in nine months, and the strength of the services sector in both Britain and the United States.

For economic news. The US Department of Commerce released a report showing that the US trade deficit narrowed significantly in November. The trade deficit narrowed to $43.1 billion in November from $46.9 billion in October. The trade deficit narrowed to its lowest level since it reached $42.0 billion in October 2016.

Economists had expected the deficit to narrow to $43.8 billion from $47.2 billion the previous month. The narrowing of the trade deficit came as the value of exports increased by 0.7 percent to $208.6 billion in November, after falling by 0.1 percent to $207.3 billion in October.

Exports of drilling equipment, oilfields, civil aircraft engines, jewelry and auto parts showed a marked increase. Meanwhile, the report said the value of imports fell 1.0 percent to $251.7 billion in November after falling 1.7 percent to $258.7 billion in October.

According to the technical analysis of gold prices: The general trend of gold price is still up, and the current global geopolitical tensions may push the prices to the following psychological resistance at $1,600 and beyond, especially if a retaliatory reaction by Iran occurs to what happened recently from the United States in Iraq. Currently, the closest support levels for gold are at 1562, 1550 and 1535, respectively. Gold will react to the announcement of the ADP survey of the change in the number of non-farm jobs in the United States of America.