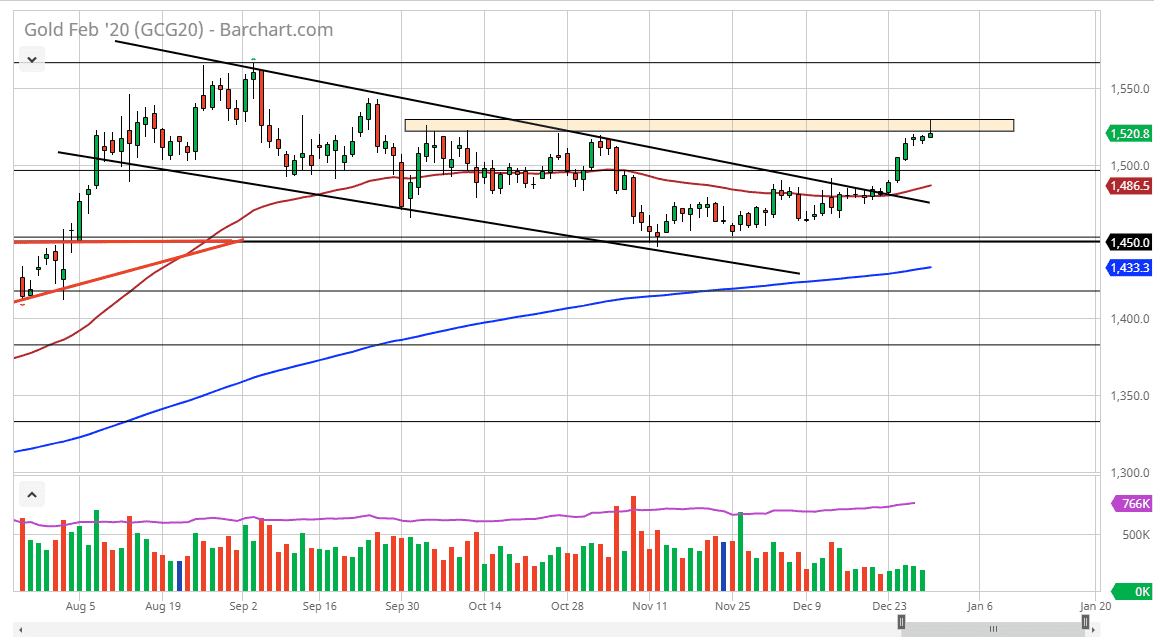

Gold markets continue to look bullish overall, but the trading session on New Year’s Eve ended up forming a shooting star. We reached towards the $1525 level but rolled right back over to form a bit of a shooting star by the end of the day. This was exacerbated by Donald Trump announcing that the United States and China would sign the so-called “Phase 1 deal” on January 15. Ultimately, this is a market that does look bullish in general but by forming the candlestick that it did I think a pullback is probably the first thing we will see for 2020. The $1500 level underneath should be rather supportive, as it is a large, round, psychologically significant figure, and of course an area that will be important due to the fact that the 50 day EMA is reaching towards that level as well.

We had recently broken above a major downtrend line, which had been very bearish for some time. However, when you look at the longer-term chart you can see that we have in fact bounce from the 38.2% Fibonacci retracement level from the longer-term trade trend that coincided quite nicely with the $1450 level, which also was the top of the ascending triangle from previous trading. Just below there, we also have the 200 day EMA which is also very supportive. In other words, there are a multitude of places that buyers will probably return if we do pull back and I would look at that as a potential buying opportunity based upon value. It’s not until we break down below the 200 day EMA that I would consider this market bearish, and obviously we would have to have a monumental shift in attitude. I think that even though the US/China trade situation is getting better, the reality is that several banks around the world continue to loosen monetary policy and I believe that the Federal Reserve is going to be right there with them. All things being equal, this is a market that I do like but I also recognize that we have gotten a bit overextended and have reached major resistance. However, I’m the first to start buying if we do break out above the top of the candlestick from the trading session on Tuesday, because it would be showing a major breakout at that point, sending this market towards the $1550 level.