Gold markets rallied a bit during the trading session on Thursday as more traders are coming back to work. Ultimately, this is a market that looks as if it is ready to go much higher, perhaps reaching towards the $1550 level. The market is a little extended at this point, but it should be noted that we broke above the top of the shooting star from the previous trading session, so that shows that we are ready to break through and continue going even higher.

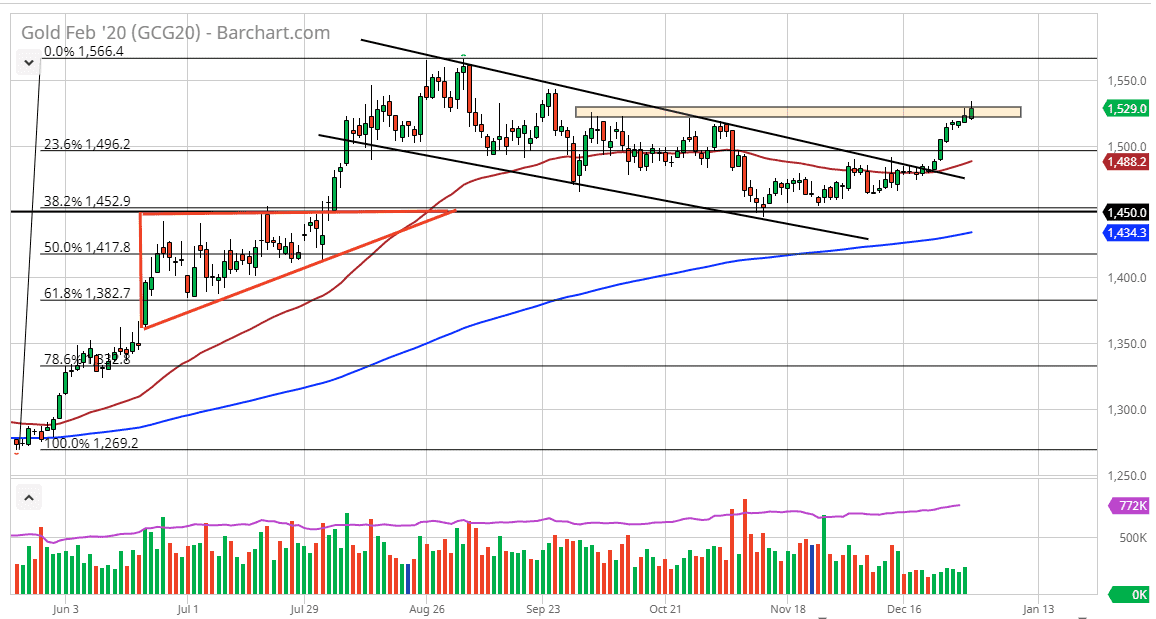

I like the idea of buying this market on dips, as it should continue to attract a lot of value hunters. The 50 day EMA is starting to curl higher and that of course is a bullish sign. We had recently broken out of that descending triangle, bouncing from the 38.2% Fibonacci retracement level in the process which of course is a sign that there is a lot of momentum for this move longer term. We have seen the US dollar take it on the chin a bit, so it makes sense that gold would get a bit of a boost. Having said that though, there are plenty of other reasons to think that perhaps gold will rally.

At this point, it wouldn’t take much to get the markets nervous, especially if it involves something to do with United States or China. The “phase 1 deal” is to be signed on January 15 so far, but at this point it’s not done and any signs that it won’t happen will send gold skyrocketing again. At this point, I believe the 50 day EMA reaching towards the $1500 level is a good sign and should offer plenty of support for buyers. If we can continue going higher, I think that eventually we will fulfill what I believe is going to happen, higher highs. This is a good environment for gold as not only do we have a lot of concern out there, there is also the possibility that the Federal Reserve is going to start loosening monetary policy later in the year. If that’s going to be the case, that’s good for gold as well. To the downside, it’s not until we break down below the 200 day EMA that I would consider shorting this market, and we are almost $100 away from that level, which would take something rather drastic to make happen, something unforeseen.