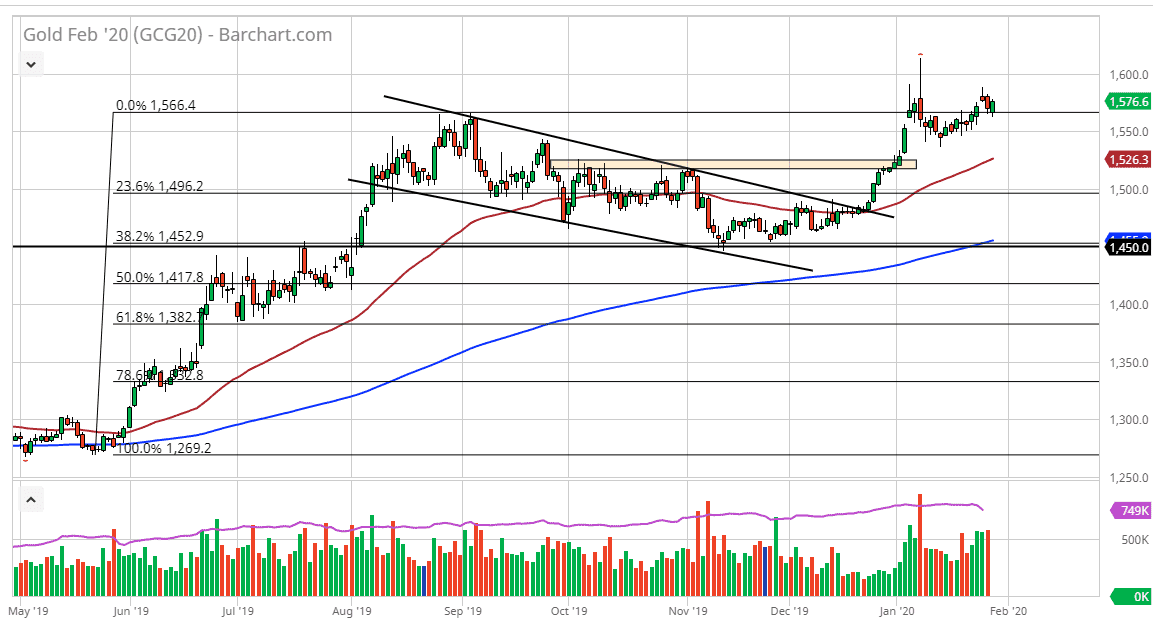

Gold markets rallied a bit during the trading session on Wednesday, bouncing from a pullback towards the $1565 level to show signs of life again. Ultimately, the market looks very likely to test the highs from a couple of days ago, and then perhaps even the $1600 level. Keep in mind that the gold market is reacting to dovish central banks around the world, and with the Federal Reserve sounding a little bit sluggish and dovish during the press conference, gold got a bit of a boost. Gold has been in an uptrend anyway, so keep in mind that it was essentially looking for a reason to go higher. Looking at the $1550 level, it’s an area that I think it’s essentially the “floor” in the market. Furthermore, the 50 day EMA looks as if it is starting to race towards that level, and it could offer quite a bit of support as well. It is currently trading at the $1525 level, an area that has been both supportive and resistive.

I have no interest in shorting gold, there are far too many reasons out there to believe that perhaps gold should rally. Not the least of which of course is the fact that central banks around the world continue to loosen monetary policy and by assets, but also interest rates are extraordinarily low but certainly have the pressure on them to rise over time. Furthermore, as we continue to devalue currencies globally, that will drive gold to the upside.

If we did break down below the 50 day EMA, then my next level of major support is closer to the $1500 level which is a large, round, psychologically significant figure anyway, so at this point it wouldn’t be a big surprise to see buyers jump in there as well. All things being equal though, the likelihood of the market dipping and seeing buyers jump in and take advantage of value makes quite a bit of sense, so therefore I don’t have any interest in shorting as it is simply far too strong of the market and gold also gets bought not only due to central banks but geopolitical issues, which we have a potential of several of them flaring up at the same time. I fully anticipate that gold will break above the $1600 level, and then go looking towards the $1800 level of the next several weeks, if not months.