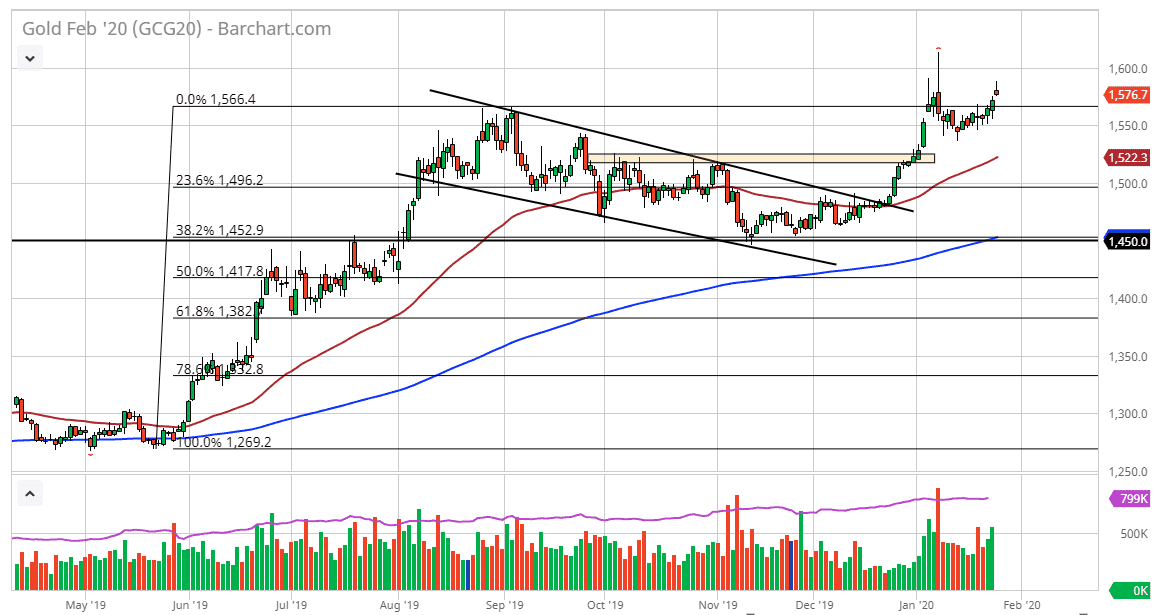

Gold markets gapped to kick off the week as the Chinese coronavirus continues to have fear coming into the market. Quite frankly though, that’s a nonsensical story as there are concerns about global growth, but at this point you can see that the daily candlestick is starting to form a shooting star, as perhaps fears are updating a bit. That being said, I believe at this point what we are looking at is a “fill the gap” scenario more than anything else. Furthermore, I see a significant amount of support underneath at the $1550 level, which formed a perfect bottom from the most recent pullback. In fact, if you squint, you can see a bit of a bullish flag.

To the upside, if we were to break above the highs from the trading session on Monday, then the market is most certainly going to try to take out the $1600 level. Breaking above there could send the market much higher, perhaps reaching towards the $1650 level, and then maybe even the $1800 level based upon the bullish flag that I see on my chart. The 50 day EMA is also starting to curve to the upside again, so that could bring in a bit of bullish pressure.

If we do break down below the $1550 level, the 50 day EMA should start to offer support which is currently at the $1525 level, an area that has been resistance in the past which should now be support. Furthermore, the $1500 level is also an area of support. It’s not until we break down below that level that I become concerned, and quite frankly we would have to have a major “risk on” type of move to sell gold that hard. There are plenty of potential issues out there that I think will come into play, so it’s only a matter of time before some type of fear enters the market that should push the gold market higher. However, a pullback looks to be relatively eminent in the short term but look at that as a potential buying opportunity as it is so obviously in an uptrend. If things get worse with the coronavirus, global trade, or perhaps some type of geopolitical issue, then gold should be one of the first places that traders will run into in order to protect themselves from global turmoil and volatility.