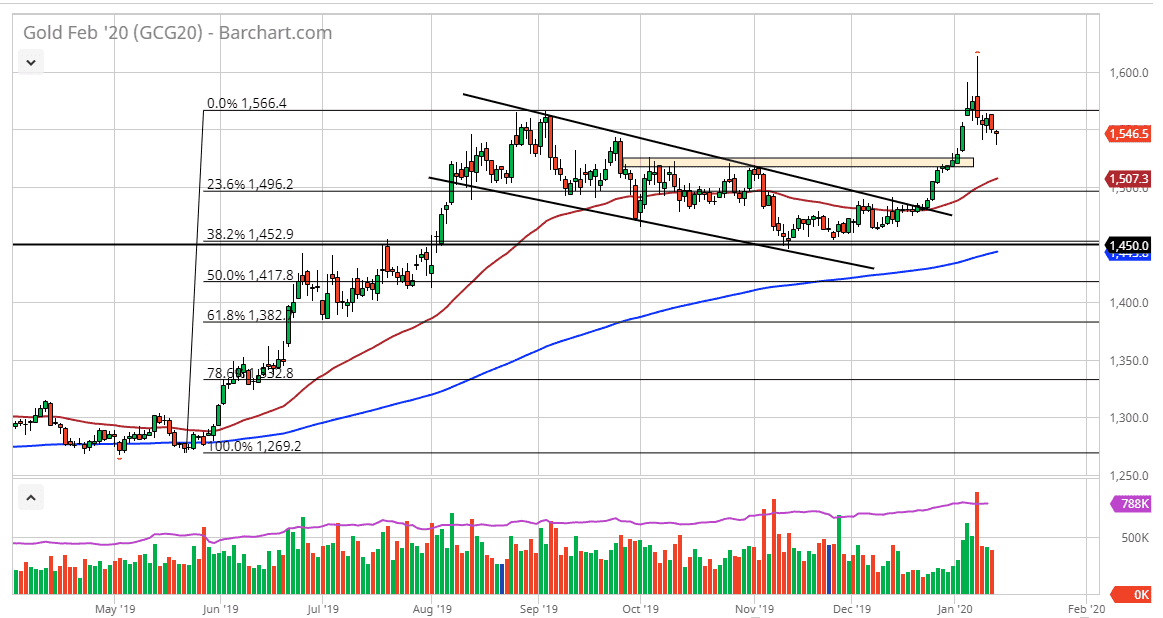

Gold markets have initially pulled back during the trading session on Tuesday but have found buyers underneath the turn around and form a bit of a hammer. This is very interesting considering that we are sitting just below the $1550 level, and it does look like we could be trying to form some type of bullish flag. I think at this point it’s likely that we are going to see this market go a bit higher, reaching towards the highs again, but we need some type of catalyst.

At this point, if we were to break down below the lows of the Tuesday session, then I think we will be looking at the $1525 level, perhaps even the 50 day EMA underneath there which is currently at the $1507 level. Either way, I don’t have any interest in shorting this market, because it has been so strong. When you look at the recent move, the fact that we have pulled back so drastically isn’t much of a surprise, considering that it was pretty much parabolic. With that being the case, I am a buyer above the $1550 level, but I think what I will probably do is build up the position relatively small.

At this point, I believe that the market is one that you should be buying on dips and hanging onto for as long as you can. $1600 will obviously be a very bullish sign, as it is the recent highs. If we can break above there, then the market will continue to grind towards the $1800 level, which has been my longer-term target for what seems like ages now. That being the case, I have an upward bias and I think at this point all we need is some type of news catalyst to send this market straight up in the air. One thing is for sure, you need to pay attention to what prices are doing, not what they “should be doing.” That is a mistake that far too many people make. If prices are rising, you can argue all you want but that’s the way this is going to go. It looks as if gold markets are in fact ready to do so, so I’m a buyer. Gold markets cause a lot of problems for traders in general, but at this point you have two options: you can start to build up a position or stay on the sidelines. Selling is all but impossible.