UK Prime Minister Boris Johnson experienced his first defeat in Parliament. While he obtained an overwhelming majority in the elected House of Commons, he doesn’t command a majority in the unelected House of Lords. This resulted in three defeats within hours, as the upper chamber seeks to force amendments to Brexit. The most significant one was the ruling on lower courts to overturn EU laws, a power currently enjoyed solely by the Supreme Court and the Scottish High Court of Justiciary. Despite the flashpoints, the GBP/USD has created a series of higher lows and seeks to re-establish its uptrend, after pushing out of its support zone.

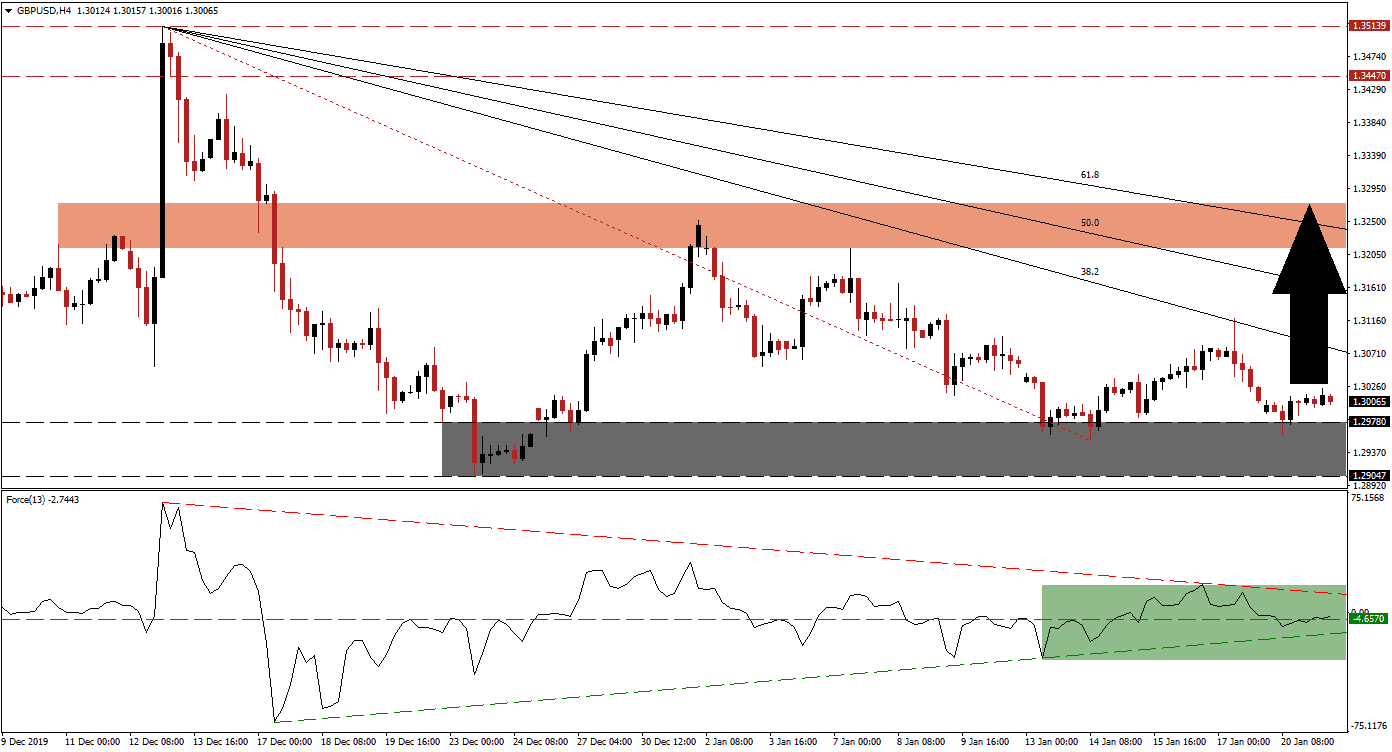

The Force Index, a next-generation technical indicator, shows the rise in bullish pressures. It also confirmed the breakout in the GBP/USD above its support zone, with a conversion of its horizontal resistance level into support, as marked by the green rectangle. A move into positive conditions is expected to follow and elevate the Force Index above its descending resistance level. This is likely to be enhanced by its ascending support level, and place bulls in control of this currency pair. You can learn more about the Force Index here.

After price action recorded a marginally higher low inside of its support zone located between 1.29047 and 1.29780, as marked by the grey rectangle, a shallow uptrend was confirmed. A breakout above its descending 38.2 Fibonacci Retracement Fan Resistance Level is favored to materialize and inspire a fresh breakout sequence in the GBP/USD. Forex traders are recommended to monitor the intra-day high of 1.31182, the peak of the previous breakout. A move above this level should result in the net addition of buy orders.

While the Bank of England has struck a more dovish tone, the recovery in the labor market is anticipated to keep the central bank on the sidelines. Wage pressures are providing a solid boost to inflation, and the next move may be an interest rate hike in 2021. The GBP/USD is positioned to push through its Fibonacci Retracement Fan sequence and challenge its short-term support zone located between 1.32140 and 1.32744, as marked by the red rectangle. A breakout is possible, on the back of US economic weakness, and the next long-term resistance zone awaits between 1.34470 and 1.35139.

GBP/USD Technical Trading Set-Up - Breakout Extension Scenario

Long Entry @ 1.30100

Take Profit @ 1.32700

Stop Loss @ 1.29400

Upside Potential: 260 pips

Downside Risk: 70 pips

Risk/Reward Ratio: 3.71

Should the Force reverse below its ascending support level and push into negative conditions, the GBP/USD is expected to follow this technical indicator to the downside. Given the dominant bullish fundamental outlook for the British Pound, any breakdown attempt is likely to remain a short-term interruption of the uptrend. The next support zone is located between 1.27639 and 1.28041. Forex traders are advised to view this as an excellent buying opportunity.

GBP/USD Technical Trading Set-Up - Limited Breakdown Scenario

Short Entry @ 1.28850

Take Profit @ 1.27850

Stop Loss @ 1.29250

Downside Potential: 100 pips

Upside Risk: 40 pips

Risk/Reward Ratio: 2.50