The pressure on the Pound did not end, after concerns about the future of Brexit calms, the Pound is facing many demands for a rate cut by the Bank of England as soon as possible, in light of a series of weaker than expected UK economic data results. This pessimism pushed the price of the GBP/USD pair down to the 1.2954 support, the lowest level in two weeks, and attempts to correct it only succeeded in testing the 1.3057, level despite the markets’ optimism after both the U.S and China signed the Phase 1 agreement, which stops the pace of war tariffs between the two, which were often a reason for the weak global economic growth, and expectations indicate that their continuation means a complete recession and paralysis of the global economy.

Official statistics revealed a sharp and sudden fall in British inflation for the month of December, which increased pressure on the Bank of England to accelerate the rate cut. The Office for National Statistics announced that inflation fell from 1.5% to 1.3% in December, and markets were expecting it to remain unchanged at 1.5%. Meanwhile, the more important core inflation index fell 40 basis points to 1.3% when expectations were for an unchanged reading of 1.7%. The core CPI is seen as a more reliable measure of domestic price trends because it excludes more volatile elements, but both inflation measures are now well below the Bank of England's 2% target.

Inflation started to decline due to weakness in the underlying economy despite the rise in oil prices, which increased pressure on the Bank of England to finally respond to the continuing weakness of the economy by reducing borrowing costs for companies and families.

Four major global central banks cut interest rates last year, amid a weakening global economy as the trade war between the United States and China continued, but the Bank of England chose to wait to see the results of Brexit negotiations. The Bank of England has kept interest rates unchanged at 0.75% since August 2018, and has been threatening to tighten its policy in the coming years because it has always been predicting higher or flexible price pressures instead of falling inflation. It did not happen.

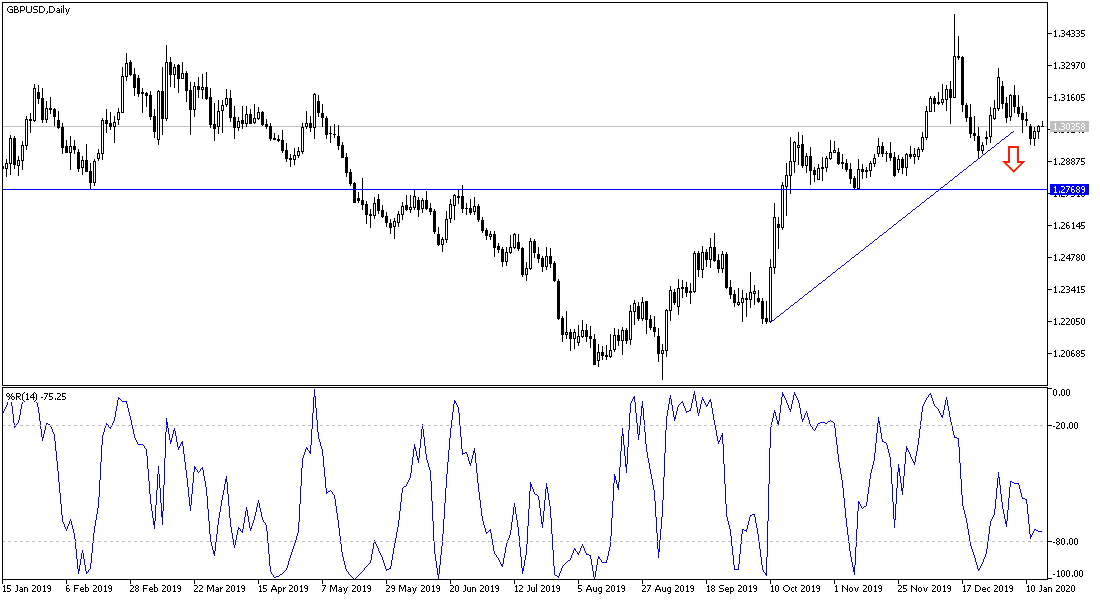

According to the technical analysis of the pair: There is no change in my technical view of the GBP/USD pair. Stability around and below the 1.3000 psychological support remains supportive for the downtrend, which is expected to get new catalysts with the continued weak performance of the British economy, and consequently, the rising expectations of the possibility of reducing interest from The Bank of England, which is meeting at the end of this month, the day before the official Brexit date, on January 31. On the upside, the nearest resistance levels for the pair are currently 1.3085, 1.3140, and 1.3220, and I still prefer to sell the pair from each upside level.

As for the economic calendar data: The focus will be on the US session data, with the release of retail sales figures, the Philadelphia industrial index, and jobless claims numbers.