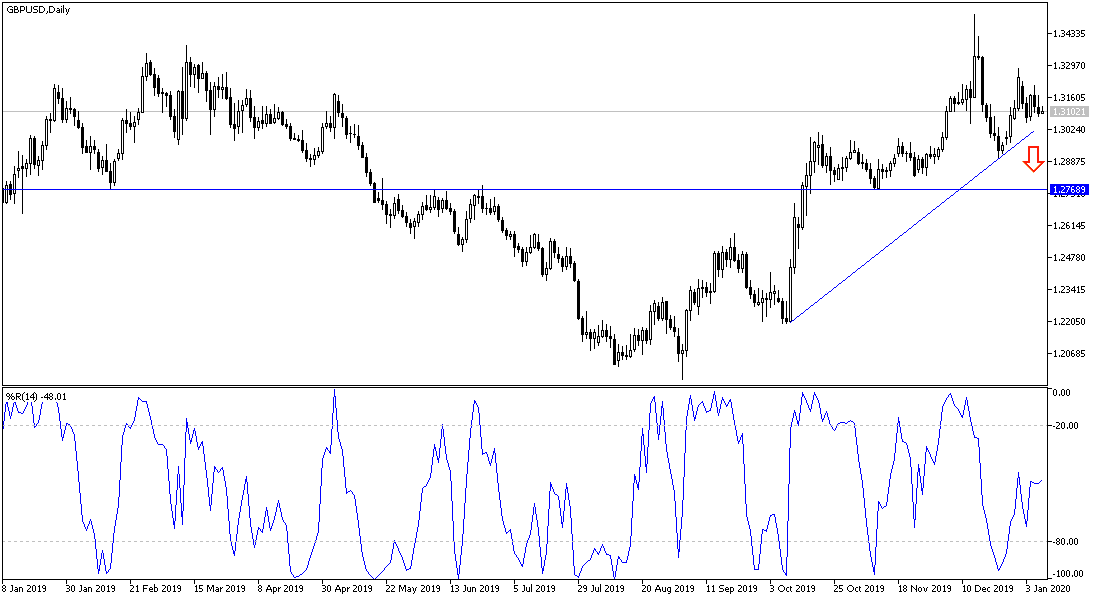

The concerns of Brexit future returned to the fore again, after the European Commission President warned Britain on Wednesday that it would not obtain "high-quality access" to the European Union market after they leave the European Union unless it made major concessions. Besides the strength of the US dollar, all factors contributed to the downward pressure of the GBP/USD price to the 1.3080 support before settling around the 1.3100 level at the time of writing. The pressure may push the pair towards the 1.3000 psychological support at the earliest.

The pound's losses came amid a sudden escalation of tensions in the Middle East that would help traditional safe-haven currencies such as the dollar and the yen. However, we did not see a strong response to foreign exchange rates - Forex - to such news. Iran has launched missiles at two air bases in Iraq with US forces, and so far there is no sign of any casualties. Geopolitical concerns can have a limited reaction to the currency trading market, which is confirmed by the weak market reaction to the news of the Iranian attack.

Iran says the attack was in retaliation for the killing of Iranian military commander Qassem Soleimani, which occurred on Friday. In response, US President Donald Trump said, "Everything is fine and so far, very good," indicating that the US President did not bother with the attack as long as there were no casualties. Crucially, if this is the worst thing Iran could offer in that crisis, then fears of the "Third World War" seem incredibly exaggerated.

Currency traders will monitor the path of intense negotiations between the UK and the European Union, and European Union Commission President Ursula Von Der Lin will meet Prime Minister Boris Johnson in Downing Street to assess the overall situation of Britain's exit from the European Union, as the two sides reduce the prospects for detailed discussions.

The negotiations between the European Union and the United Kingdom on Brexit were sometimes marked by frictions and negative briefings, and the Pound was reacting with poor performance.

According to the technical analysis of the pair: The GBP/USD pair is trying hard to avoid moving towards the 1.3000 psychological support, which supports the strength of the downtrend. As we expect and confirm now, there is no strength for the bullish correction again without the pair moving steadily above the 1.3300 resistance. Brexit developments, the US trade agreement with China, and the situation in the Middle East, are all factors that fluctuate the performance of this pair in the coming period.