For the third consecutive day, the price of the GBP/USD pair is attempting to bounce back after sell-offs that pushed it towards the 1.3053 support after investors fled to the dollar as a safe haven due to the new tensions between the United States and Iran, after the killing of Qasim Soleimani, a prominent Iranian military commander accused by the states of hitting U.S targets that harm their interests in the region. Attempts to rebound did not exceed the 1.3178 resistance, as the markets awaited the Iranian response. The trade war between the United States and China is expected to lead to a stronger dollar, despite the signing of the first-stage agreement between the two.

The dollar's recovery will return after months of decline in the world's most liquid currency, which has been steadily losing value since October 2019. Accordingly, the dollar index DXY - a measure of the dollar’s value against a basket of six major currencies - reached 99.60 in October before falling back to its lowest level of 96.40 at the end of 2019. The year 2020 saw the US currency regain some losses, and the index currently appears at 96.89.

Financial markets, including the Forex currency market, are on high alert due to signs of escalation after US President Donald Trump said on Sunday that the United States will "strike, possibly in a disproportionate manner" if there are any other attacks on the American people or property in the Middle East. The warning came after his Twitter tweets on Saturday, in which he said that Washington had chosen 52 locations inside Iran that would be targeted in the event of more attacks on US interests in the region.

For economic news. A closely monitored survey showed that the British economy is expected to recover in the first months of 2020 as more clarity emerges about Britain's exit from the European Union in the wake of the landslide election victory by Conservatives led by Boris Johnson. The country is preparing to exit the bloc by January 31. There will be a marathon after that to lay out the commercial and political relations between the two sides in the transitional period, which Johnson wishes not to exceed 2020.

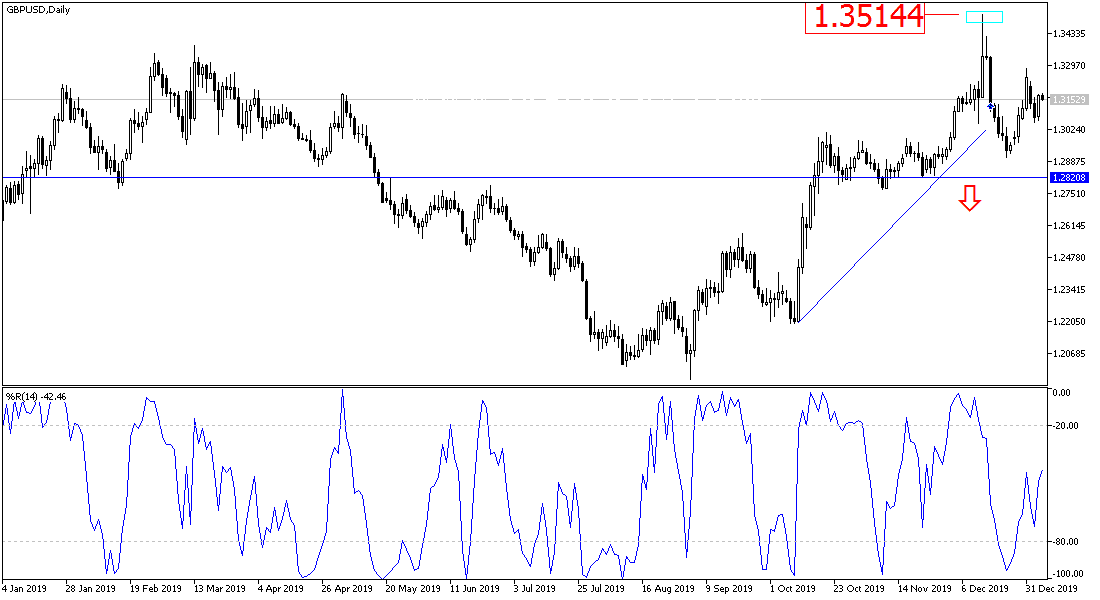

According to the technical analysis of the pair: There is no change in my technical view of the GBP/USD pair, as the stability of the performance above the 1.3000 resistance gives the pair the opportunity to correct higher. In case of stability above 1.3300 resistance, the strength of this reversal will be confirmed. Any collapse in the price of the pair below the 1.3000 level will give a strong impetus to the bears and end the current bullish expectations.

On the economic data front: From Britain, the rate of spending on real estate loans will be announced. From the United States, the Trade Balance, ISM Services Purchasing Managers Index and factory orders will be announced.