Attempts for a bullish correction for the GBP/USD pair are still weak, with the continued USD strength, despite the monetary policy announcement from the US central bank, the pair did not exceed its gains at 1.3030, after falling back towards the 1.2975 support. The Fed, as expected, kept interest rates unchanged. Today, the pair will react to the Bank of England's announcement of its monetary policy at the last meeting of the Bank under the leadership of Mark Carney.

Regarding leaving interest rates unchanged, the Fed said it viewed the current monetary policy stance as appropriate to support the continued growth of economic activity, strong labor market conditions and the return of inflation to the 2 percent target. The bank added that it will continue to monitor the implications of information provided on the economic outlook, including global developments and silent inflation pressures, as it assesses the appropriate course for prices.

The consensus decision to leave interest rates unchanged was widely expected by economists, as Fed officials indicated that the central bank would remain on hold for the foreseeable future unless there was a fundamental shift in the economic outlook. CME's FedWatch tool currently indicates a 76.1 percent chance that the Federal Reserve will leave interest rates unchanged at its next meeting in March.

In his press conference following the meeting, Federal Reserve Chairman Jerome Powell acknowledged that some uncertainties about trade had diminished after the signing of the US-China Phase 1 trade agreement. Powell noted that there are still some uncertainties about the global economic outlook, with the President of the Federal Reserve specifically referring to the outbreak of the new Corona virus.

As for the Bank of England’s meeting today, no change in the bank's policy is widely expected, and the bank may keep rates as is at 0.75%. There will be careful monitoring of the contents of the monetary policy statement, economic forecasts and Carney's last statements as governor of the Bank of England.

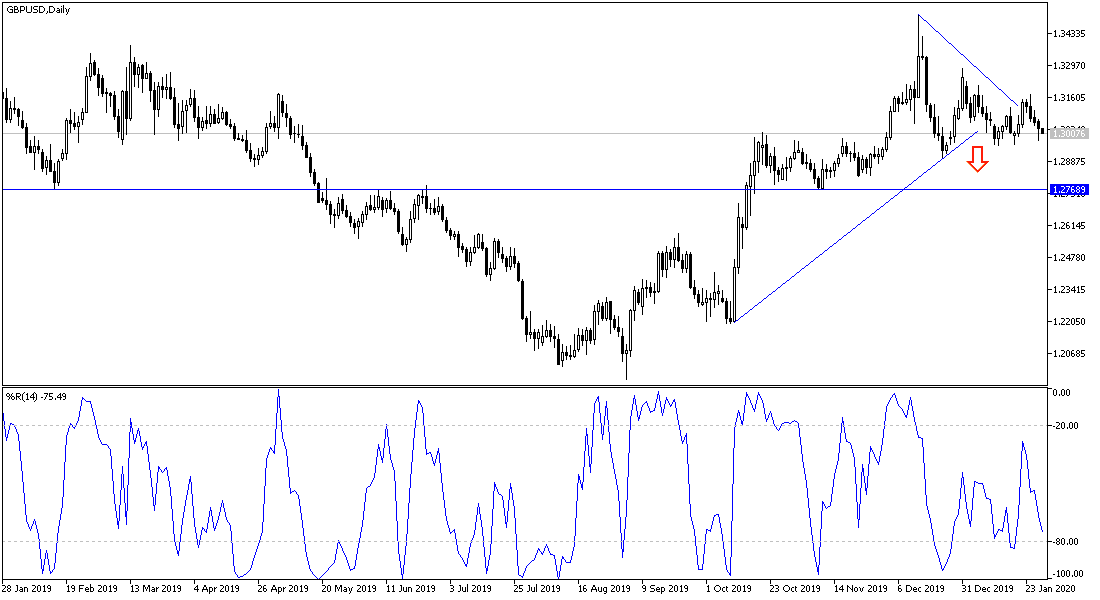

According to the technical analysis of the pair: On the daily chart, the GBP/USD pair confirmed the head and shoulders formation, and despite the technical indicators reaching oversold areas, stability below 1.3000 psychological support will continue to support the bear's control over the performance. Support levels at 1.2970 and 1.2890, respectively, may be the closest to the performance of the current pair. As we expected before, we now confirm that the pair will not have a strong opportunity for a bullish correction without crossing the 1.3300 resistance, which is unlikely until the end of this week’s trading.

As for today's economic calendar data: From the U.K, all focus will be on BoE policy. From the United States, GDP growth rate and jobless claims will be announced.