For three consecutive trading sessions, the price of the GBP/USD pair is in a bullish corrective move, with gains reaching the 1.3152 resistance before settling around 1.3120 at the time of writing. The Cable gained momentum from the easing of pressure regarding interest rate cuts by the Bank of England soon, especially after the announcement of data results, which showed optimism among British companies, which rose sharply in January, providing additional evidence that January 30 may be premature for the Bank of England to cut interest rates. According to the latest CBI orders, total orders slightly improved to -22 compared to -28 previously. This number was better than the -25 analyst expectations. This is a significant increase in optimism and reflects the optimism announced in the Deloitte CFO poll that showed “an unprecedented rise in business sentiment” after the December general election.

The data indicates that the economy may show a recovery in the coming months, and when combined with previously announced labor market statistics that came in better than expected, the Bank of England has no good reason to accelerate the rate cuts at their meeting on January 30. The pound struggled in the first half of January, as many Bank of England policy makers indicated that they were ready to cut interest rates due to a slowdown in the British economy, according to data that monitored 2019 performance.

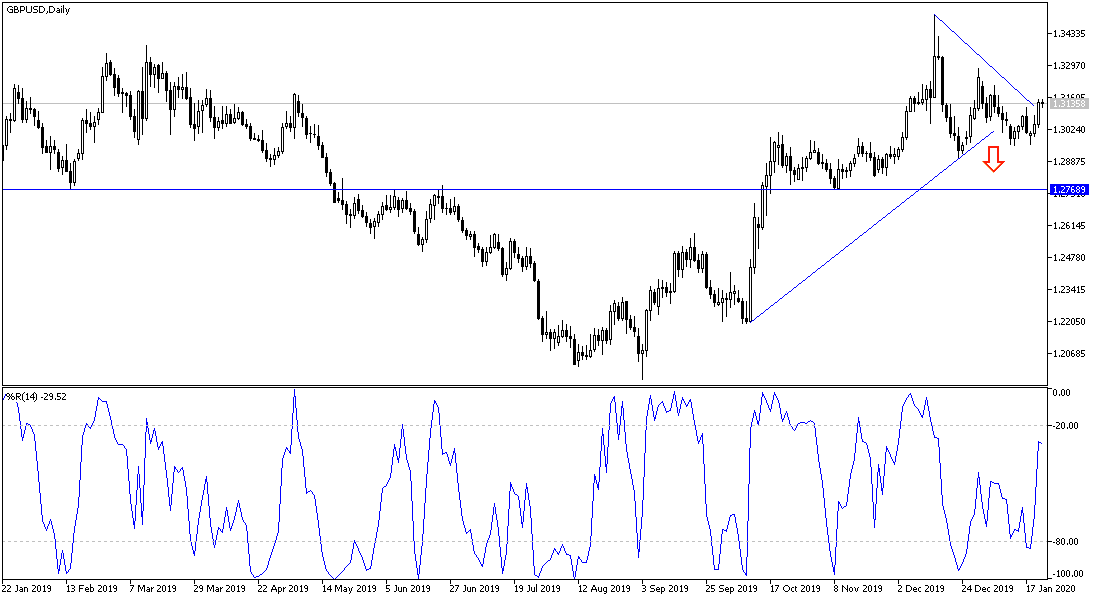

Expectations for the rate cut increased sharply to more than 70%, according to the financial markets, and accordingly, the pressure on the pound increased, as it recently collapsed to the $1.2961 level.

Tomorrow, the PMI survey for the UK industry and services sectors will be released, which are important data that will clear the picture more. The results will give a comprehensive view of the U.K performance in the post-election period. The Bank of England's monetary policy committee - charged with setting interest rates - has indicated that it can base its final decision on the results of this survey. In a speech earlier this month, member of the Monetary Policy Committee, Jertjan Fligg, stated that if the survey fails to show significant improvement, he will vote in favor of a rate cut.

According to the technical analysis of the pair: The GBP/USD pair has returned to a bullish correction attempt, and there will be no strong and confirmed reversal of the upward trend without the pair moving towards the 1.3300 resistance. On the downside, psychological support at 1.3000 is still key to the bear control. Tomorrow's results will detrimental for the direction until the BoE meeting at the end of this month, in addition to the official Brexit date.

As for the economic calendar data: There are no significant UK data releases today. From the United States, weekly jobless claims will be announced.