The improvement in job numbers and wages in the UK has not completely ended the pessimism that occurred after the announcement of the GDP growth and inflation figures from the UK, and recent statements by the monetary policy makers of the Bank of England, which indicate the possibility of reducing interest rates at the earliest time to avoid further weakening of the country's economic performance, and preparing the end of this month to exit the European Union. The GBP/USD attempts did not exceed 1.3083 level before the pair settled around 1.3050 at the time of writing. The 1.3000 Psychological support is still supporting the downside strength more than the opportunity for upward correction.

The results of the official economic data showed that the unemployment rate in Britain remained around the lowest level since 1970 and wages continued to be higher than expected. Those results dampened expectations for a rate cut soon from the Bank of England, but the focus is now awaiting the results of the purchasing managers ’indexes for the industrial and services sectors in Britain, which will be announced on Friday, and if it provided positive more than expectations, the pound might find a stronger chance to achieve gains that would support a bullish weekly close.

The British pound was negatively affected by the statements of the country's Minister of Treasury Sajid Javed that the UK would not be left “bound” under the future relationship agreement the government hopes to conclude with the European Union. Javed also said before a regular meeting of European Union finance ministers that there would be no "agreement" with the Brussels rules on goods and services after the end of the transitional period, which is now expected to last between January 31, the date of the Brexit, and the end of the year.

Analysts and economists argue that the UK will face greater barriers to trade with the European Union if the government abides by its current plans of wanting to be free to set the path for its own policy rather than follow directions from Brussels in the future. Such lower access could slow economic growth if the government does not compensate for it by boosting access to other markets.

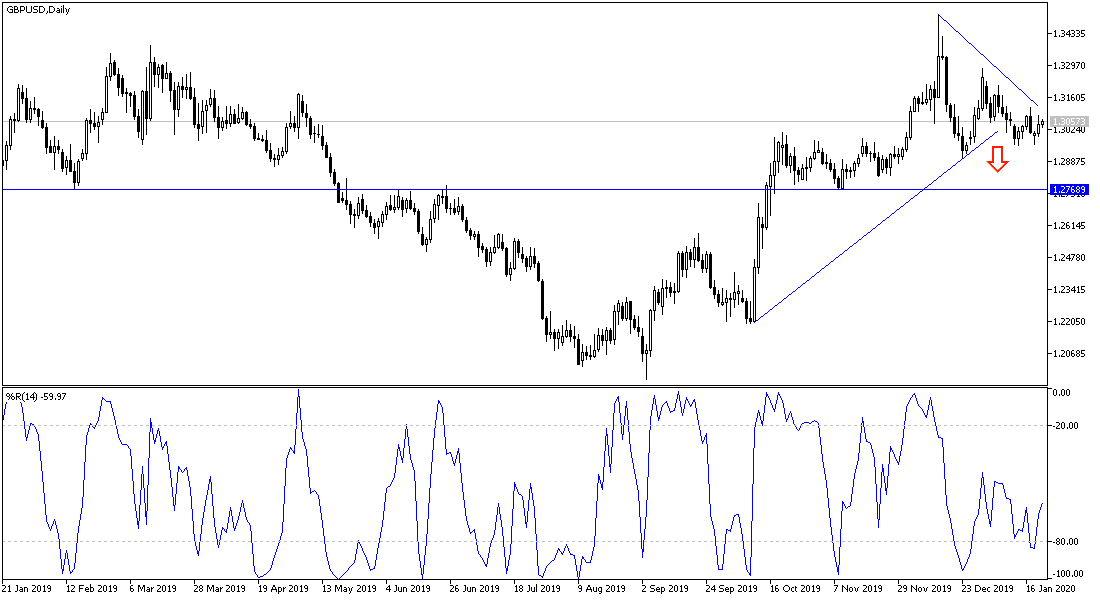

According to the technical analysis of the pair: On the daily chart, the GBP/USD pair is still in a downward path, supported by stability around and below the 1.3000 psychological level. Its gains will at any time be targets for sale unless the British economy shows positivity, removes recent pessimism and the Bank of England is adjusting its tone towards easing monetary policy ahead of its meeting on January 30. There will be no control of the bulls without the pair moving towards the 1.3300 resistance.

As for the economic calendar data: From Britain, the public sector net borrowing will be announced. From the United States, existing home sales data will be released.