The GBP/USD price is trying to stabilize above the 1.3000 support to avoid further downward pressure, and the pair has fallen recently to the 1.2961 support, with increasing expectations for a near rate cut by the Bank of England, after a series of important British economic data results, which confirmed the extent to which the country's economic performance has weakened, despite the demise of some of the uncertainty regarding Brexit, following a landslide victory for conservatives in a general election in December 2019. 10 days from now, it will be the official date for Britain's exit from the European Union. The pair’s attempts to bounce have not exceeded the 1.3021 level yet.

The markets are absorbing the latest developments in trade negotiations between the European Union and the United Kingdom and are awaiting a major set of economic data due to be released at the end of the week, which will ultimately determine whether the Bank of England will cut interest rates when it meets on January 30.

Weekend comments from British Treasury Secretary, Sajid Javed, indicated that the UK will not seek alignment with the EU’s rules as basis for its future trade relations, instead, the UK will seek freedom to move away from the EU’s rules that in turn will allow the country to seek foreign trade and deals with other countries. "There will be no alignment, we will not be committed to the rules, we will not be in the single market and we will not be in the customs union - and we will do so by the end of the year," Javed told the Financial. Adding, companies must "adapt" to the new reality.

The European Union wants the UK to stay close to its own regulations in exchange for a zero tariff and zero quotas, but Prime Minister Boris Johnson has repeatedly pledged to break out of the EU’s rules. Two weeks ago, European Commission President Ursula von der Lahn said on a visit to London that while she wanted the European Union and the United Kingdom to be as similar as possible, the more contrast the United Kingdom wanted, the lower the future business relationship can be. By moving away from European Union rules, the UK will be exposed to more trade barriers from the European Union, as it seeks to protect its economy from unfair advantages.

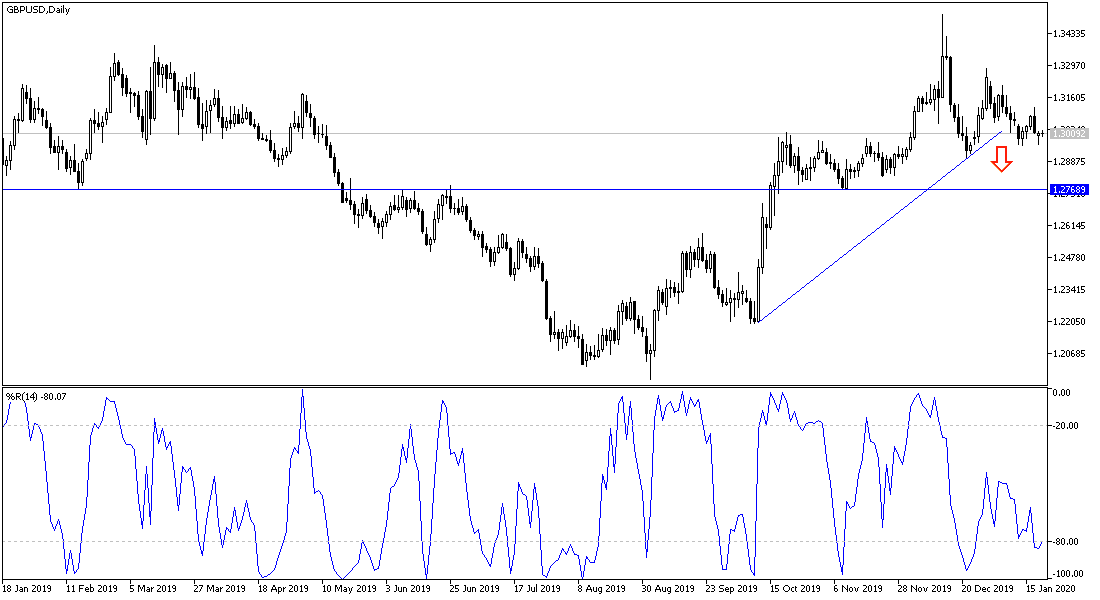

According to the technical analysis of the pair: The continuation of a series of negative results from the British economy will support more downward pressure for the GBP/USD pair, and as long as it is stable around and below the 1.3000 psychological support, the general trend will continue to tend more towards further decline. At the present time, the closest support levels for the pair are at 1.2960, 1.2880 and 1.2800, respectively, and there will be no control of the bulls to performance without the pair moving towards the 1.3300 resistance, otherwise the stronger trend will remain bearish.

As for the economic calendar data: From Britain, the average wages index, the rate of change in unemployment and the unemployment rate will be announced. For the second day, the economic calendar contains no significant data from the United States.