Within a series of important British economic releases for this week, and after the announcement of the GDP growth rate, the focus during the trading session today, Wednesday, will be on the announcement of British inflation figures - consumer prices and producer prices - and if they come in below expectations, interest rate cut expectations by the Bank of England will increase soon, and thus the pressure on the performance of the pound against the other major currencies increases. The announcement of the British economy contraction to the lowest level since 2012 pushed the GBP/USD pair to collapse to 1.2954 support, the lowest level in two weeks, before bouncing back to 1.3033 at the time of writing, after announcing the weakness of US inflation figures, and amid optimism in the markets before today’s signing on the Phase 1 trade agreement between the U.S and China.

The British pound may drop further against the dollar in the coming weeks, because it is not ready at the present to reduce the interest rate, which is expected at the Bank of England meeting at the end of this month. The pound sterling is among the worst performers in the past week, and the price of the pound against the dollar has fallen by more than 1% in recent days as policymakers from the Bank of England began preparing markets to cut interest rates.

Member of the Monetary Policy Committee, Gertan Fleigh, said that he will vote in favor of cutting interest rates this month if the British economy showed more weak numbers, echoing those comments made by the Governor of the Bank, Mark Carney, and some monetary policy makers last week.

At the beginning of the week, the Office of National Statistics announced that the British economy had contracted by -0.3% in the month of November, which led to a decrease in gross domestic product by -0.2% in the last quarter, with only one month remaining in 2019. The British economy witnessed a growth of 0.7 % In 11 months till end of November, but markets were expecting 1.3% for the whole year.

At the BoE monetary policy meeting in December, two members of the nine-member monetary policy committee already voted to cut interest rates, so if the governor and his colleagues were to vote in that way on January 30, the rate cut will be more likely. Once the first cut happens, there will be ample of room for further easing in the bond market later on, which is sure to have a significant effect on the British pound.

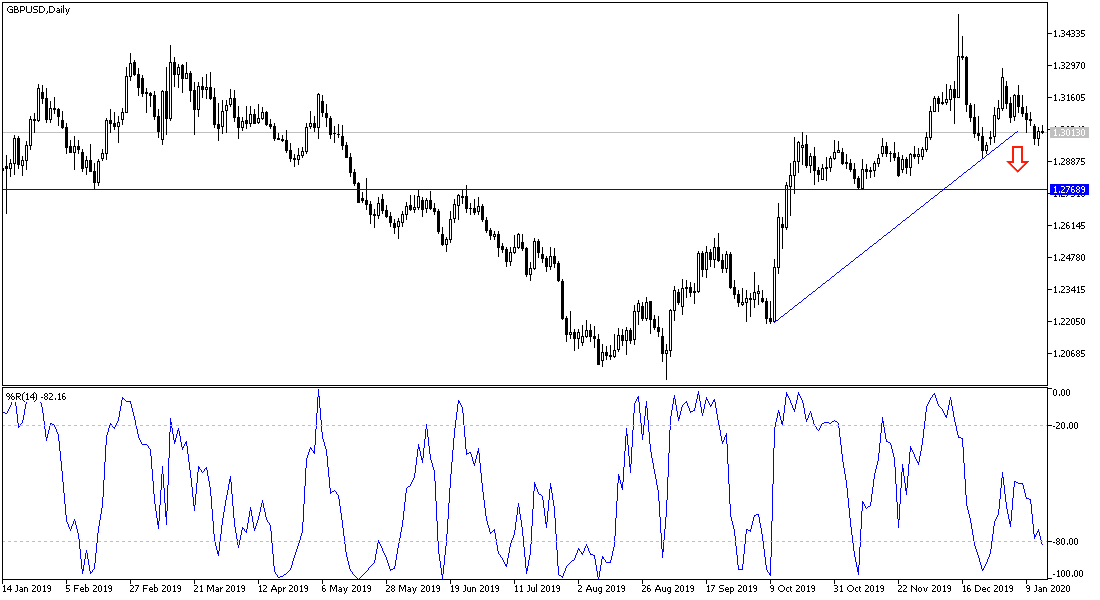

According to the technical analysis of the pair: On the GBP/USD graph, there is a clear break of the general trend towards a further move below the 1.3000 psychological support level. Amid the pessimistic outlook towards the Bank of England policy, and the economic performance of the United Kingdom before the official Brexit date on January 31. Pair's gains will remain targets for sale, and the closest resistance levels are currently at 1.3085, 1.3135 and 1.3220, respectively.

As for the economic calendar data: From the U.K, inflation figures will be announced through the Consumer Price Index, producer price index and the retail price index. From the U.S, the Producer Price Index, the Empire State Industrial Index, and U.S oil stocks data will be released.