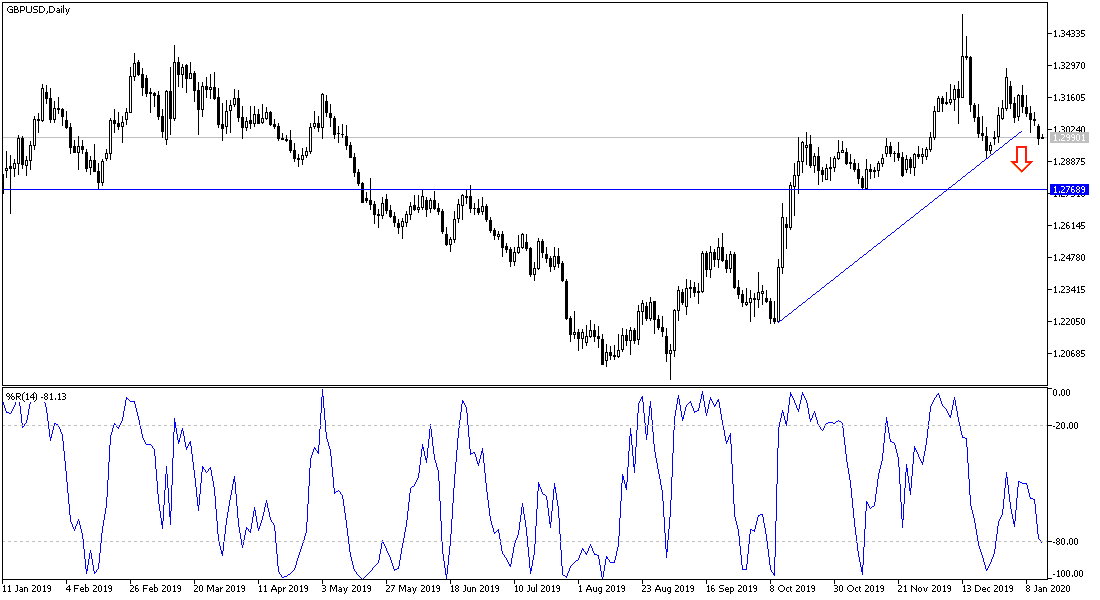

There is no doubt that the announcement of the British economy shrinking yesterday to the lowest level in 2012 confirms the concerns of the monetary policy makers of the Bank of England, which recently supported the possibility of lowering interest rates by the bank, instead of the market expectations of lifting them. This change added pressure on the GBP/USD price by moving towards the 1.2960 support level before settling around 1.2990 at the time of writing. As we expected before, we now confirm that holding the pair below the 1.3000 psychological support will act as a catalyst for the downside correction.

The United Kingdom will officially exit the European Union at the end of this month. Then there will be an 11-month transition period. In it, the United Kingdom and the European Union will negotiate their new trade relations. Hence the risks start, and the Pound will be exposed to more fluctuation in performance against other major currencies. After Britain’s exit from the European Union was affected by delays and embarrassing setbacks, Prime Minister Boris Johnson, after gaining a new majority, insists on finishing trade talks by the end of 2020. This is an ambitious time frame, but the European Union has another opinion. They think that such agreements need more time to review, audit and approve by the rest of the member states in a way that guarantees the best interest of both parties.

On the economic level. November's GDP data showed that the British economy slowed - 0.3% in that month. The National Bureau of Statistics also indicated that industrial production fell by -1.7%, which is much deeper than the 0.3% contraction forecast by the markets. The latest data results confirm the British economy slowed sharply in 2019, and unless there are signs of a clear recovery in economic activity after the UK general elections, the Bank of England is likely to cut interest rates.

The services and production sectors contributed positively to GDP growth in the three months to November 2019, growing by 0.1% and 1.1%, respectively. However, the production sector fell 0.6% in the same period, in the second consecutive three-month decline. Industrial production made by far the largest downward contribution to the overall decline in industrial production, dropping by - 0.8%, with a negative contribution from 10 of the 13 sub-sectors. The persistence of weak British economic performance may force Boris Johnson to extend the post-Brexit transition period, and pressure the BoE monetary policy makers to further ease monetary policy.

According to the technical analysis of the pair: As mentioned before in the technical analyzes, the stability of the GBP/USD pair below the 1.3000 psychological support will remain supportive of the bear's control of the performance and foreshadow a stronger downward move that may reach the support areas at 1.2960, 1.2880 and 1.2800, respectively. The performance will continue to decline unless the direction of the pair changes again towards the 1.3300 resistance, and after yesterday's data, we still prefer to sell the pair from each upside level.

There are no significant UK economic data announcements today. From the U.S, the CPI, the first release of the US inflation, will be released.