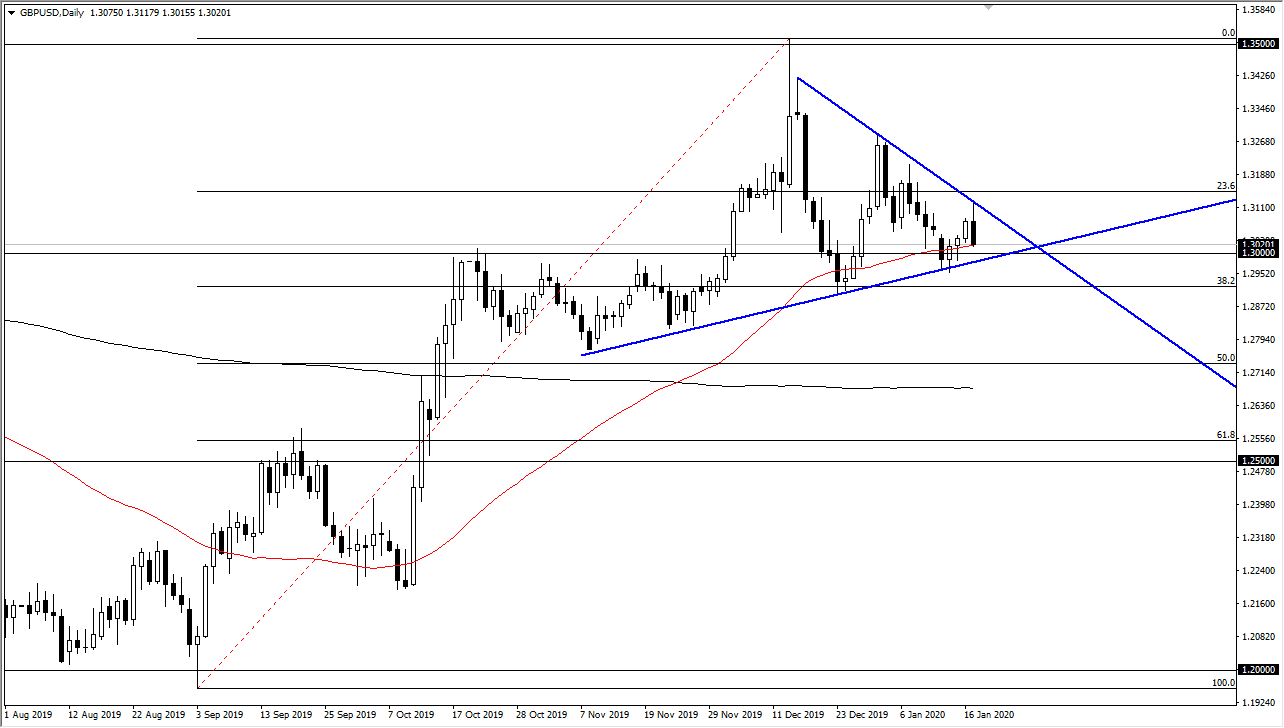

The British pound shows signs of choppiness going into the Monday session after the Friday retail sales figures were so soft. Looking at this chart, you can see there is a nice uptrend line underneath, so it’s likely that there will be a sense of support, not only from the uptrend line, but from the 1.30 level, and of course the 50 day EMA. That being said, this is a market that looks as if it is trying to tighten up and build up enough inertia to break in one direction or the other.

You will notice that there has been a sequence of higher lows, but we have also had lower highs, meaning that we are consolidating in compressing. Eventually we will make some type of decision, and once we do it will more than likely be an explosive one. Keep in mind that this pair is paying attention to the Brexit and all of the noise involving that situation.

Retail sales falling the way they have of course doesn’t help, and it has quite a few more traders out there thinking that perhaps the Bank of England will cut rates at the end of the month, but at this point I have to question whether or not that is something that people are paying attention to. After all, lower interest rates of course suggests that it could be a weaker British pound but let’s be honest here: we have not been trading on interest rates for the last three years. It’s all about what happens with the Brexit going forward, so although the central bank cutting interest rates would of course work against the value of the British pound, it’s not the be-all and end-all that it would normally be.

If we do break down significantly, perhaps down below the 1.2950 level, then I think we will probably go looking towards 1.28 a handle underneath which is the bottom of the bullish flag that sent us higher to begin with. Otherwise, if we break above the top of the candlestick from the session on Friday, then this market should go much higher as we would be making a breakout of the downtrend line. Expect a lot of noise, and an explosive move sooner or later. The candlestick is very negative for the trading session on Friday, but there is also a significant amount of support just below.