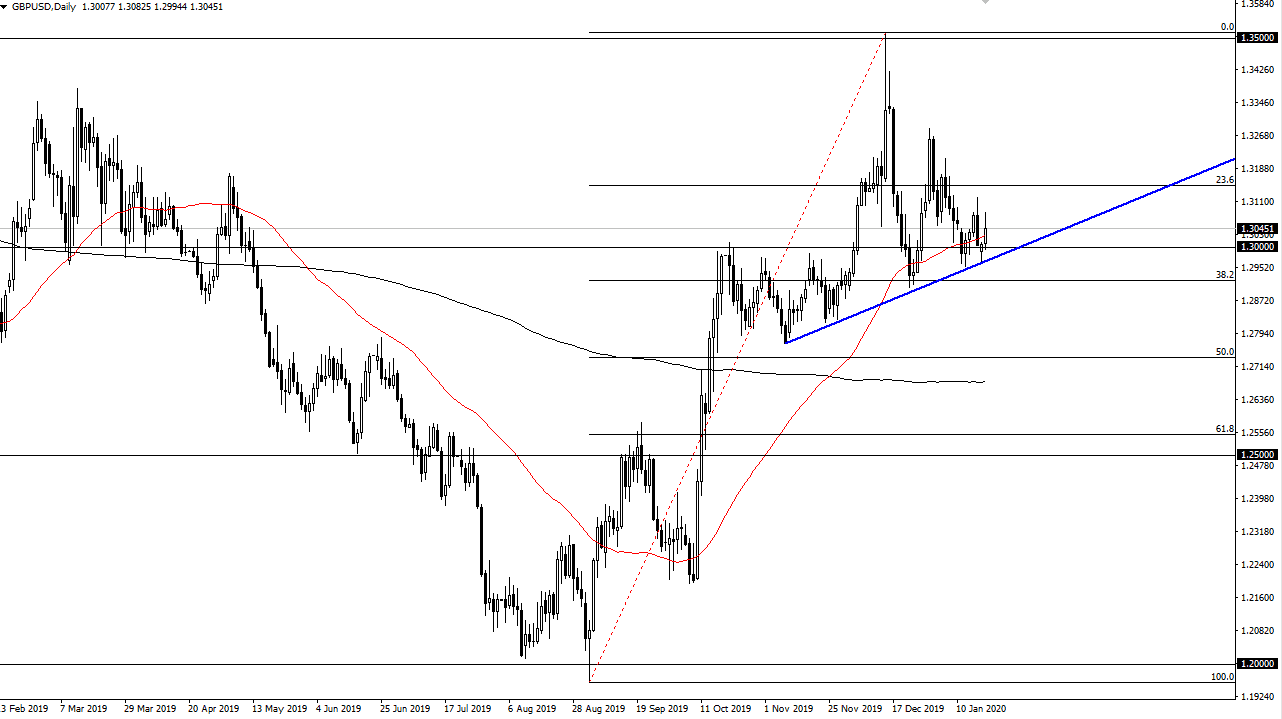

The British pound has rallied a bit during the trading session on Tuesday, as traders came back to work in New York. The market broke above the 50 day EMA to show signs of strength, as we continue to dance along the uptrend line. The market has also recognized that the 1.30 level is a large, round, psychologically significant figure and an area that is rather crucial. Because of this, it’s very likely that we will continue to see buyers jump into this marketplace, but I do not expect some type of massive break higher.

One of the main reasons we rallied was not only due to a technical nature, but also due to the employment figures in Great Britain been much better than anticipated. The day did give back about half of the gains, so having said that it shows that we will continue to see a lot of noisy action, but as long as we can stay above the top of the hammer from the Monday session, I believe that the market is still one that you should look at through the lens of positivity more than anything else. At this point, if the market was to break above the top of the candlestick during the trading session on Tuesday, then it’s likely that we will try to break above the 1.31 handle, and then of course the 1.3250 level after that.

Looking at the volatility in this pair, it will continue to be very noisy due to the fact that the market is trying to weigh whether or not the Bank of England is going to be cutting interest rates at the end of the month. This will probably continue to be a very noisy currency pair, at least between now and then. Ultimately, if we break down below the hammer from the Monday session, then it’s likely that we would go down to the 1.29 handle, perhaps even the 1.27 level after that. Looking at this market, I see choppiness everywhere, and therefore although I favor the upside a bit, the reality is that nothing is going to be easy and therefore I look at this as a situation where we bounce from time to time, but I’m not looking for a massive breakout for any length of time. However, once we get past the central bank meeting later this month, we might have the ability to rally towards the 1.35 handle then.