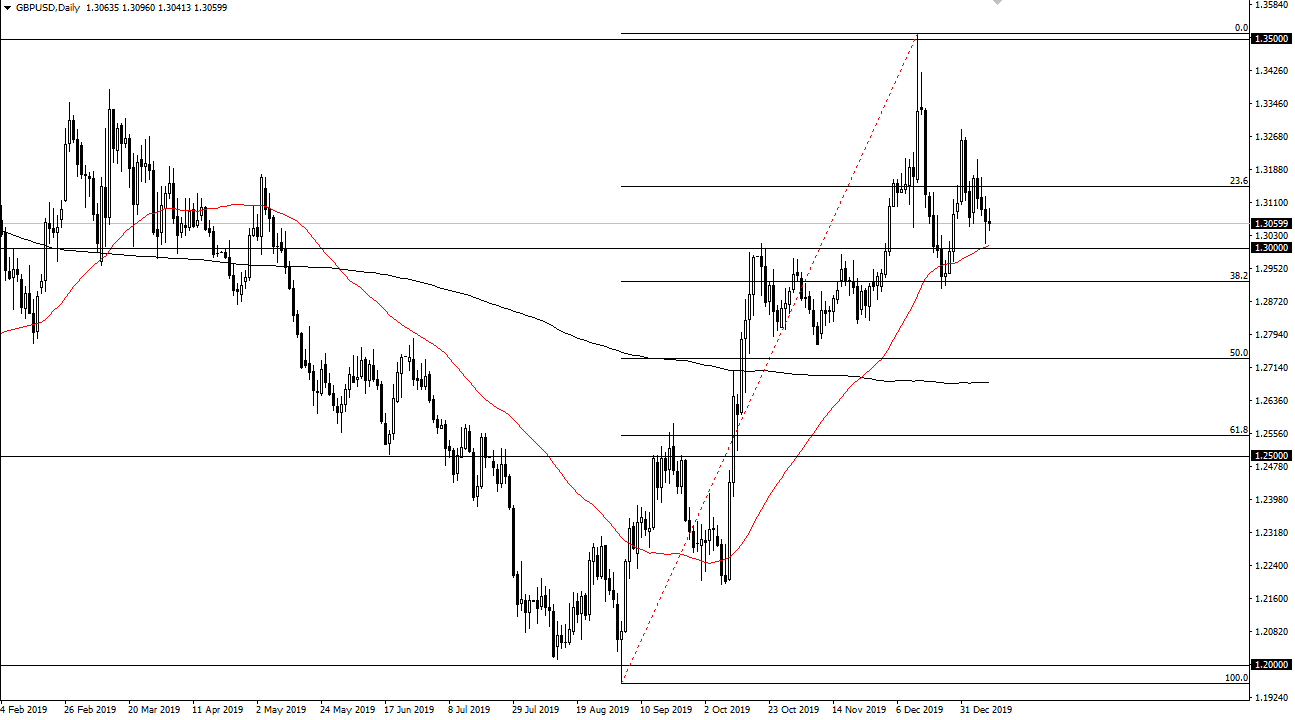

The British pound has stabilized a bit over the last 48 hours, which of course is exactly what it needs to see in order to keep the move to the upside still possible. The Thursday candlestick was a hammer, and the Friday candlestick was a doji, or neutral candle. We are sitting just above the 50 day EMA, which is cutting to the upside. Ultimately, this is a market that looks very likely to continue finding plenty of reasons to go higher based upon the Brexit and of course the fact that the British pound is historically cheap right now.

Furthermore, the United States missed the mark when it comes to the jobs number, so that should only continue to push his market to the upside. All things being equal, this is a market that should continue to see a range between the 1.2950 level, and the 1.35 level longer-term. It does look as if we are trying to break to the upside, so although I don’t think it’s going to be an easy trade to take, I am bullish. A break above the hammer from the Thursday session would have be buying, but I don’t necessarily think that we are going to shoot straight up in the air. Having said that, there is always the possibility of a headline involving Brexit that could send the British pound higher, or lower for that matter.

Boris Johnson has announced that the United Kingdom will be negotiating with both the European Union and the United States for a free trade agreement simultaneously, putting a bit of pressure on the Europeans. Because of this, the likely move is higher for the British pound simply because they are in a much better spot than they had been previously. At this point, the market is likely to continue to favor buying on the dips, but you will need to be very patient about putting money to work. That being said though, a longer-term investment certainly makes quite a bit of sense as I’ve been putting together a core position, adding slowly and building up for a trade that I’m hoping lasts for several years. Ultimately, the British pound is undervalued from a longer-term standpoint and it is probably only a matter of time before we break above the 1.35 level and go looking towards 1.38 level, which is the target based upon the bullish flag that I have been talking about for weeks.