At the end of the month, we will have an interesting meeting for the Bank of England, as there are a lot of traders out there trying to discern whether or not the central bank is going to cut interest rates. Recently, we have seen some better economic announcements that suggests that perhaps they will not have to. This is essentially what’s been driving the British pound as of late, and from a technical analysis standpoint, it has, at the right time.

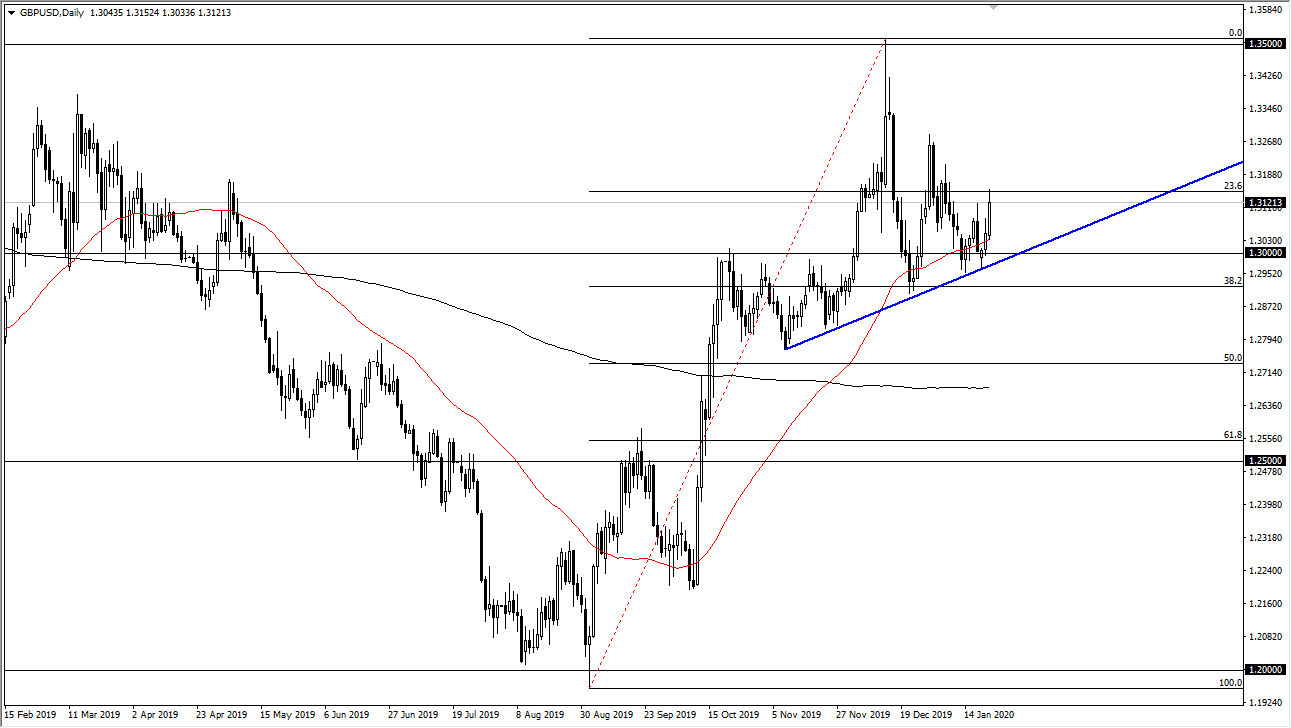

Looking at the chart, you can see that the 50 day EMA has been broken, and we have even broken above the highs from the Friday session from last week, and therefore it shows that we have certainly had some follow-through. Furthermore, the hammer from Monday bounce directly from a significant uptrend line, so that’s something that’s worth paying attention to as well. Ultimately, I believe that this market will try to go much higher, perhaps reaching towards the 1.35 handle given enough time.

Do not forget that the other part of this equation comes down to the Federal Reserve and whether or not they are going to continue adding assets to their balance sheet which is essentially a “stealth QE 4” for lack of a better term. With that, we may start to see the US dollar lose a bit of value, but ultimately at this point it comes down to whether or not the Brexit situation moves forward as well. It may be a bit quiet in the short term, but quite frankly that’s not necessarily a bad thing as far as the British pound is concerned. I currently like the idea of buying dips, but I recognize that there could be a lot of noise occasionally as we chop back and forth. Because of this, it’s very interesting to see that the market pulled back slightly, but still has formed a very bullish looking candlestick for the trading session. With that in mind, I remain bullish, but I also recognize that you will need to be very cautious about your position size as the move higher is probably going to be very difficult over the next several weeks. If we were to turn around a break down below the hammer from Monday though, that would be an extraordinarily negative sign and therefore would have me reevaluating this entire situation.