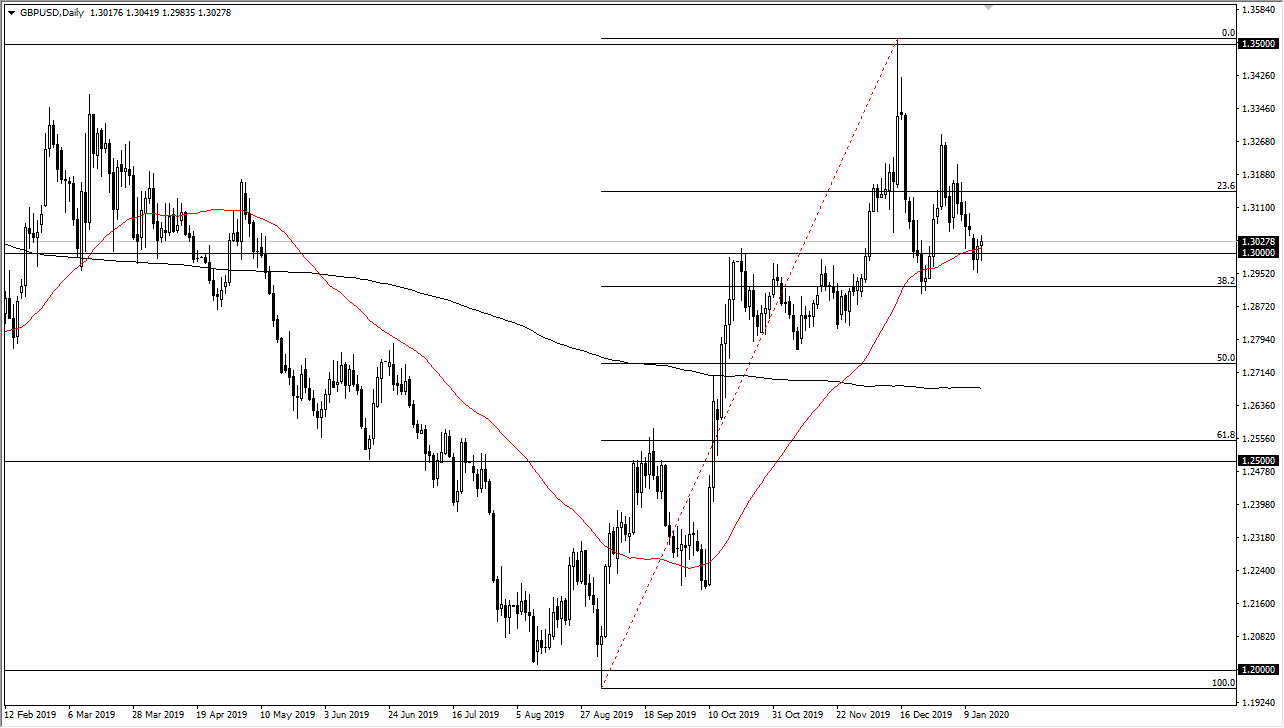

The British pound has broken down a bit during the trading session on Wednesday but found support underneath the 50 day EMA yet again to turn around and form a bit of a hammer. The gap above should continue to be resistive, and if we can break above there, then the market is free to go much higher. I believe that the British pound is still going to find plenty of buyers based upon the fact that it is so cheap, at least from a historical perspective.

Underneath, I believe there is a significant amount of support based upon the bullish flag between the 1.30 level and the 1.28 level underneath. That being the case, I believe it’s only a matter of time before the buyers return, unless of course something horrible happens involving the Brexit situation, something that seems to be moving along at this point. We are now in a longer term quiet portion of the debate, as the United Kingdom government has been united, it’s very likely that we will continue to see a push higher in this pair given enough time. That doesn’t mean that we go straight up in the air, but it does mean that buyers can jump in and take advantage of value.

At this point, if you were to break higher in this market is very likely that the market will find the 1.32 level as resistance, and then perhaps even the 1.35 level after that. The shape of the candlestick for the trading session of course is very bullish, following the bullish candlestick on Tuesday as well. That little gap just above is the gateway to much higher pricing. If that gets blown through, then it is a complete reversal from the initial shock selloff on Monday, and that the market is ready to continue to go higher for an attempt to break the back of resistance. The US dollar has got sold off a bit in a “risk off” move due to the US/China trade war as well, and it should also be noted that the 38.2% Fibonacci retracement level has been supportive, and typically when you see a 38.2% retracement get support, it means that there is a lot of momentum for the longer-term move to the upside. All of that being said, the market does break down below the 1.28 handle, then we will more than likely go looking towards the 200 day EMA which is colored in black.