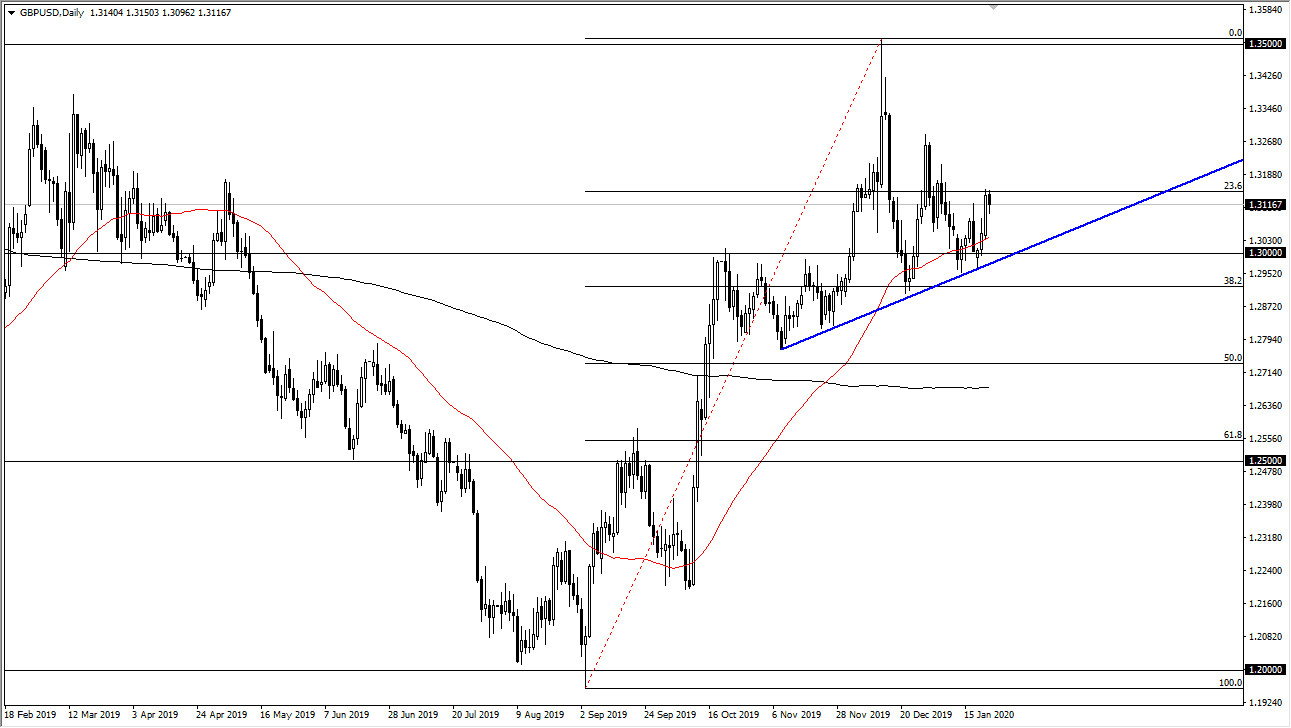

The British pound has pulled back a bit during the trading session on Thursday but has found a bit of buying pressure and bounce a bit towards the end of the day. Ultimately, the market is trying to grind a bit higher, and as you can see it has been very noisy. Nonetheless, it’s important to pay attention to the 50 day EMA as it has shown quite a bit of support. This chart looks a lot like one that is trying to continue the overall uptrend, but it’s also obvious that there has been quite a bit of back-and-forth. This makes sense, considering that we are still dealing with the possibility of Brexit headlines, and of course the possibility of the Bank of England cutting rates at the end of the month.

Recently, we have seen employment figures in Great Britain come out much better than anticipated, and that has helped the idea of the Bank of England possibly staying on hold. That of course is good for the British pound, and therefore we have recovered a right at the trend line underneath it has been so supportive. In fact, we had formed a hammer the day before so you can make an argument that the market had already been leaning in that direction anyway.

Looking at this chart, there is obviously a lot of noise at the 1.3150 level, but I think if we can break above there the market probably has another 100 pips to the upside in the short term. Longer-term, I believe that we are in fact going to go looking towards 1.35 handle, which obviously is going to take a certain amount of time and effort.

As far as selling this pair is concerned, I would be hesitant to do so anytime soon, as the pair has been so reliable, he positive until recently. That being said, you could even make an argument for a bit of a triangle or wedge forming, if you can wipe out the spike after the election results. Regardless, this is a market that looks like it is going to go higher, so I like buying dips and will continue to do so going into the future. However, if we were to break down below the 1.2950 level, then I believe that the market could have further to go to the downside in order to reach towards the 200 day EMA.