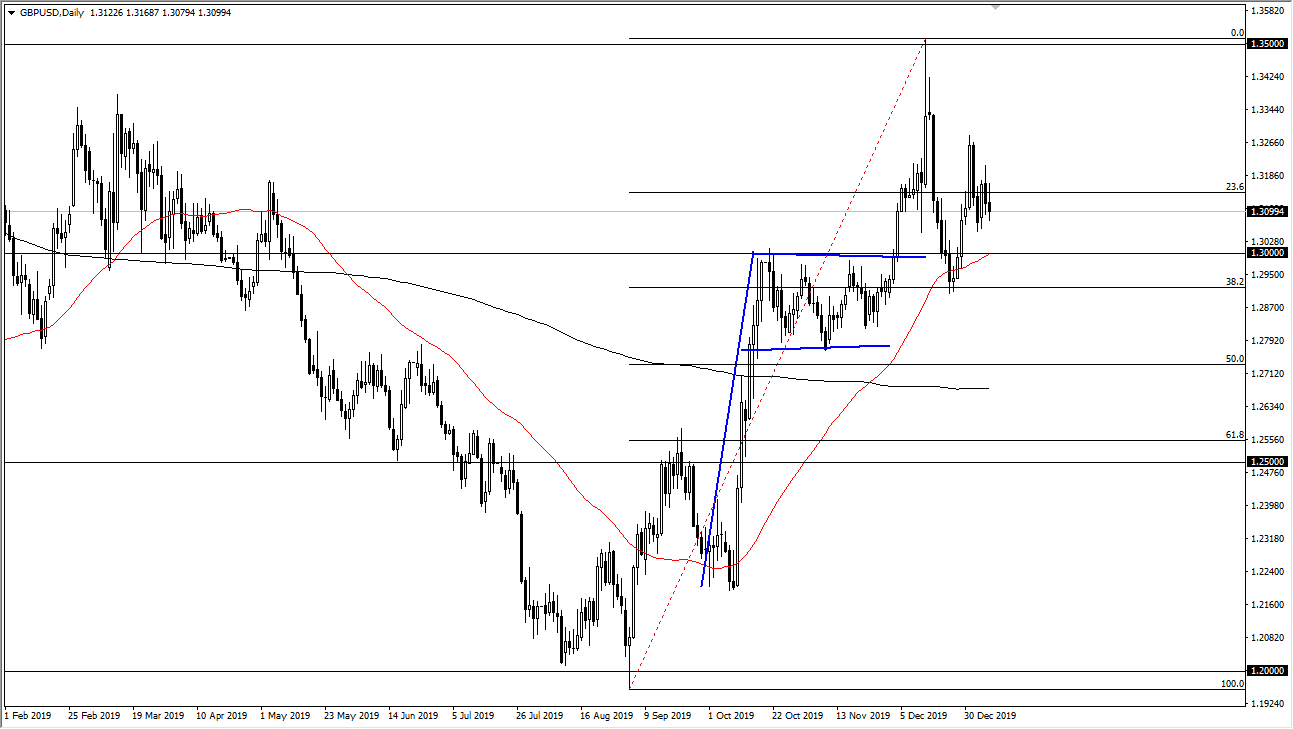

The British pound has initially gone to the upside during the trading session on Wednesday, but then turned around to show signs of exhaustion. Looking at this chart, you can see that we are starting to chop around in this general vicinity, as the range has tightened over the last couple of days. At this point, the market breaking down from here does make a bit of sense considering how the candlestick has formed what I think there is plenty of support underneath at the 1.30 level. Ultimately, the 1.30 level underneath also has the 50 day EMA, and therefore I think that there will be plenty of buyers down there to take advantage of value. Furthermore, there has been a bullish flag previously, and it has held so far.

Signs of a bounce are more than likely going to be jumped on, but with Thursday being the day before Nine Farm Payroll numbers, it’s very unlikely that the market will move much unless of course we get some type of headline involving Brexit that moves the currency. All things being equal, typically the day before the jobs number in America the markets are relatively quiet. I do think that given enough time we will go higher though, reaching towards the 1.35 level. Remember that the bullish flag measures for a move to the 1.38 handle, but that doesn’t mean that will get there overnight. Ultimately, buyers will continue to see plenty of reasons to get involved with the British pound, as the negotiations between London and Brussels carry-on. The British are going to leave the European Union on January 31 and are looking to negotiate a free trade agreement with the EU and the US simultaneously. This puts the British in the driver seat when it comes to the EU negotiations, and I think we will continue to see that played out in the currency markets. That being said, we have been a bit overextended, so it makes sense that we needed to pull back from here. I have no interest in shorting the British pound but would be much more interested in buying closer to the 1.30 level if we get a bit of a bounce. Also, I would like to see a “higher low” than the previous one that touched the 50 day EMA. All things being equal, the market is likely to be noisy so keep that in mind and keep your position size small.