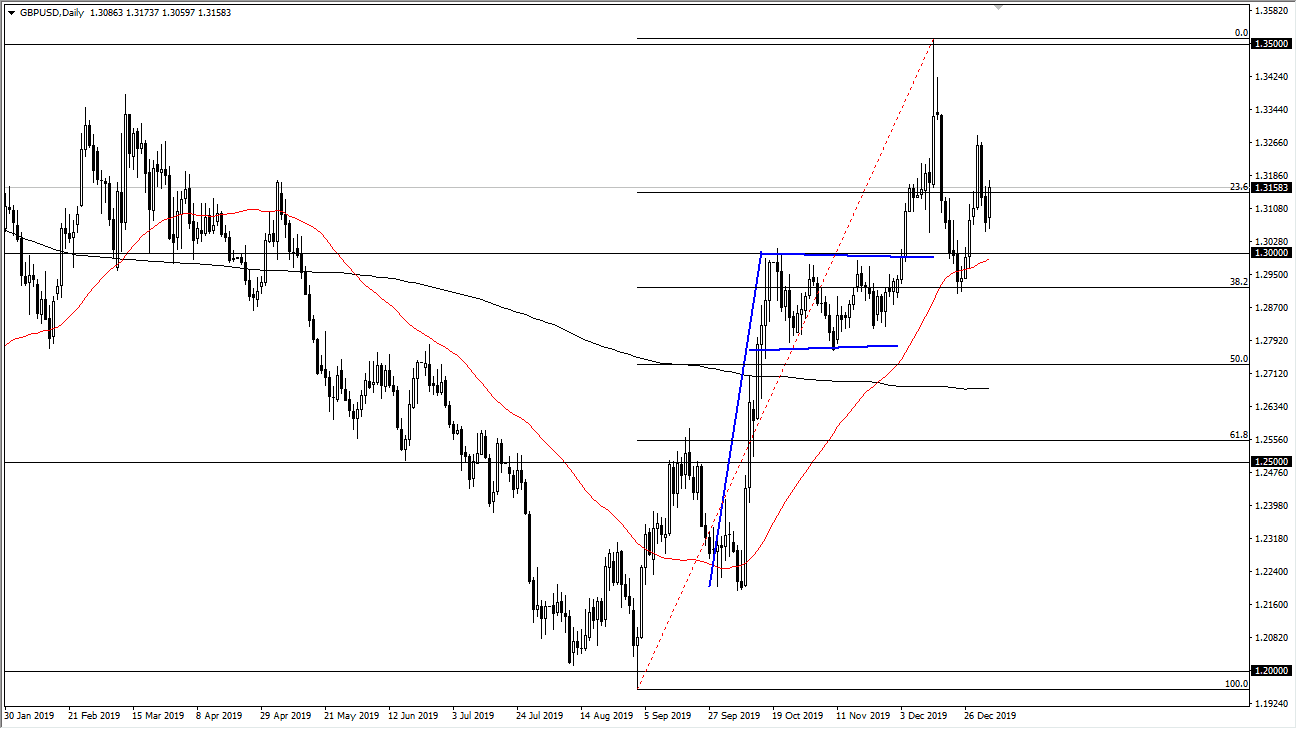

The British pound has rallied a bit during the trading session on Monday, as we continue to see a lot of volatility. If the British pound can continue to reach higher, and break above the 1.3266 level, it would send a move towards the 1.35 level as very likely. The market is currently dealing with a lot of uncertainty, but Boris Johnson announced that he was going to work on a free trade deal with both the EU and the US, simultaneously. This could put pressure on the Europeans as it creates competition and therefore it could move the Brexit talks right along. The European Union will lose Great Britain on January 31, with a grace period of changing any of the dealings until the end of the year. The next year is going to be very difficult to navigate, but it’s clearly a market that favors the upside for the longer term.

Pullbacks should see plenty of support near the 1.30 level, that extends all the way down to the 1.28 level underneath as it is the bottom of the bullish flag. Ultimately, the flag measures for a move to the 1.38 level but that will take a significant amount of momentum to happen. In the meantime, the 1.35 level will be the immediate target, and I also believe that short-term pullback should be thought of as buying opportunities as well.

If the market was to break down below the 1.28 handle, that would be a very negative sign and could open up the British pound to moving down to the 1.25 handle. That’s an area that has a lot of structural support attached to it as well, but if we were to reach towards that number, it would shake the confidence of the British pound of buyers. All things being equal, this is a market that looks like it’s trying to break out but there will be a lot of noise. This is a scenario where you can look for value, but it’s difficult to get overly aggressive to the upside. I certainly wouldn’t be a seller though, at least not until we break down through the bottom of the bullish flag, something that would take a lot of selling pressure. Ultimately, this is a market that is messy and will continue to move based upon the latest headlines, but overall I still believe in the upside, as we are starting to get a little bit more in the way of certainty.