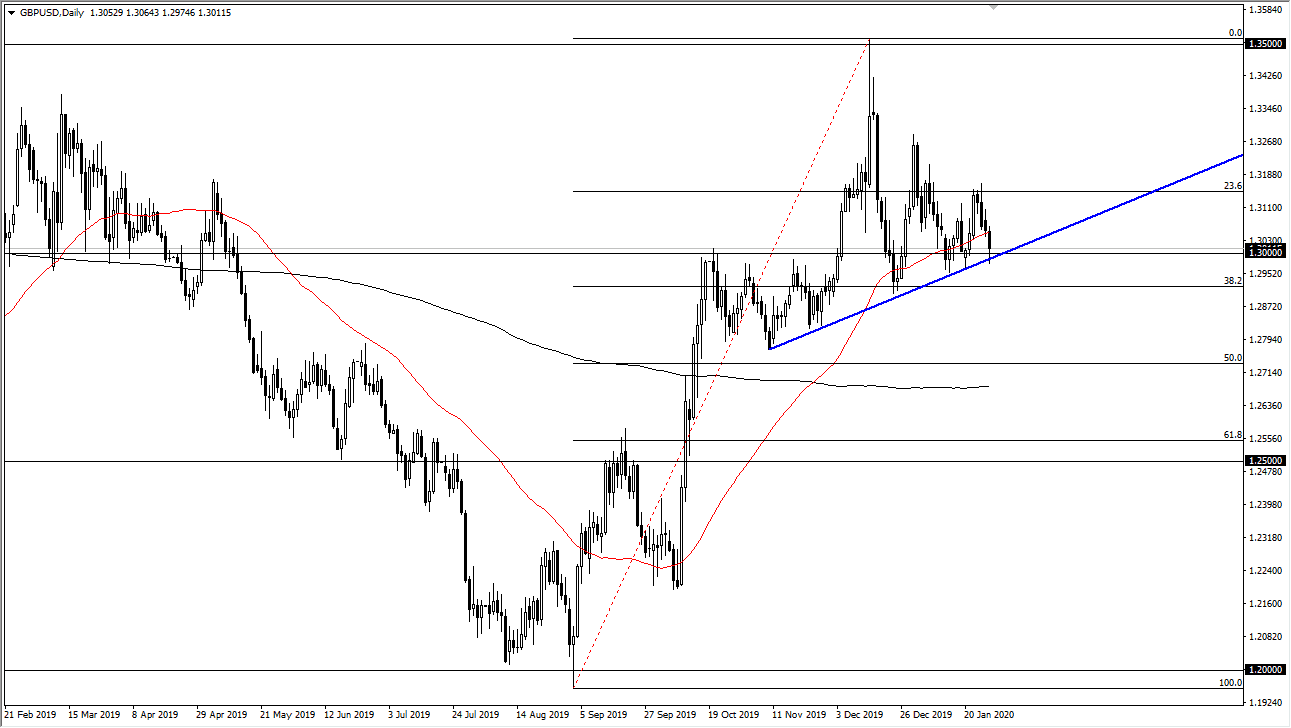

The British pound has pulled back a bit during the trading session on Wednesday but continues to find support near the uptrend line that has been important for some time. Ultimately, this is a market that should continue to find buyers underneath that we have the Bank of England coming with an interest rate decision first thing on Thursday, so that obviously will come into play. That being said, if we were to break down below the 1.2950 level, the market could drop to the 1.28 level where there should be significant support. Ultimately, this is a market that has been going back and forth, as we are awaiting the interest rate decision. All things being equal, this is a market that I think continues to see buyers underneath, and of course the 1.30 level will attract a lot of attention in and of itself.

Ultimately, this is a market that is trying to find some type of direction, and that will probably be found via the interest rate decision and more importantly the statement during the session on Thursday. If we do break down, it could unwind quite a bit but there are a lot of questions as to whether or not the Bank of England is going to need to cut rates or if they are going to go on hold. There has been a lot of economic figures recently that have been better than anticipated, so that is part of the reason why some traders may believe that London may be on hold for a while. If that’s the case, then should be good for the British pound in general, but obviously the statement will come into play as well.

At this point it makes quite a bit of sense to simply wait on the sidelines to see how the market shakes out at the end of the day, as it is clearly a very volatile day just waiting to happen, and therefore you will need to be extraordinarily cautious. However, this could be the day that determines the next couple of months as far as the trend is concerned, so missing the first couple of hours won’t necessarily be disastrous. It’s very likely that the market will respect this trendline at least for a while, and that trendline being held would be an extraordinarily bullish sign to say the least.