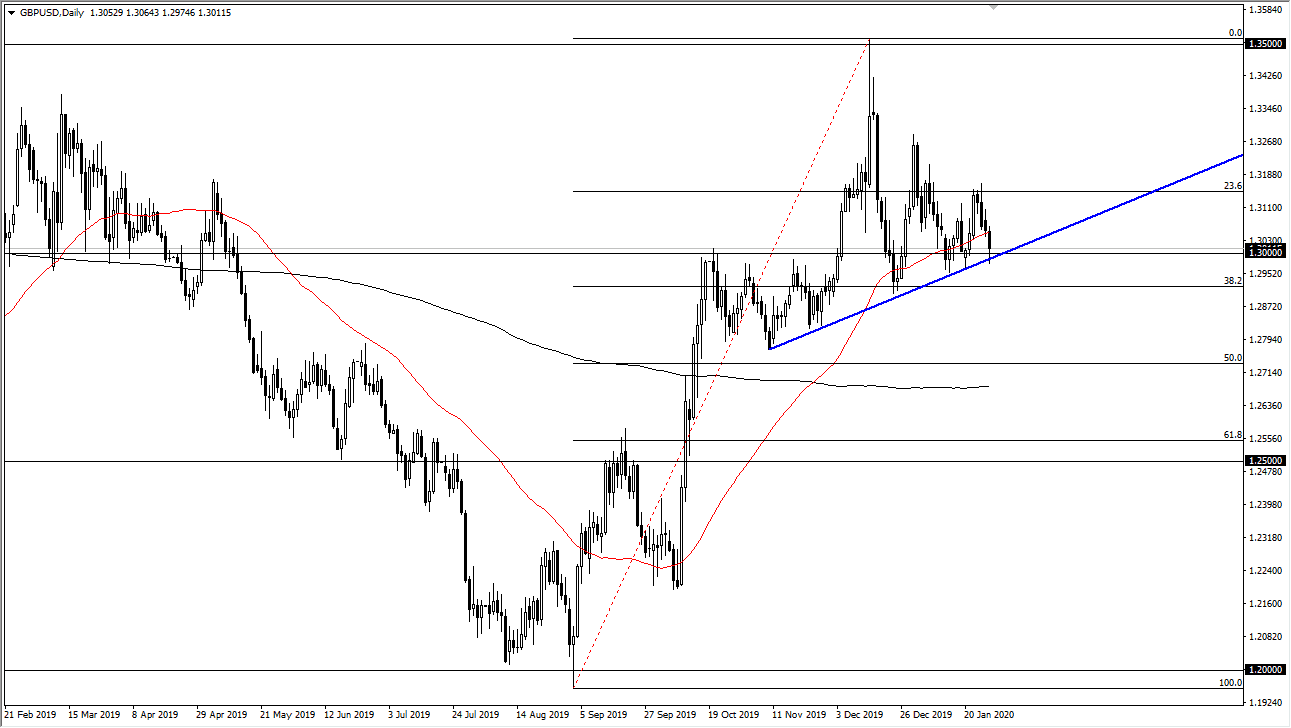

The British pound broke down significantly during the trading session initially on Tuesday, slicing through the 1.30 level. That being said, the market looks as if it is ready to continue going higher, and therefore it will be interesting to see how the Wednesday session plays out. This is mainly because we have the FOMC statement, which of course is highly influential for the US dollar. At this point, we have been rallying for some time and I think the fact that the market formed a hammer on the four hour chart towards the end of the day suggests to me that we are more than likely going to continue to go higher.

On the other hand, if we were to break through the bottom of the daily candlestick it’s likely that the market will test the 1.2950 level, and then eventually go below there. If we were to break down below that level, it’s likely that the market then goes looking towards 1.28 level underneath. All things being equal though, the market will continue to grind its way higher, and as the Brexit continues to be worked through, we should continue to see the British pound extended to the upside. Furthermore, it should be noted that the recent economic numbers coming out of the United Kingdom have been improving, so I do think that it is only a matter of time before the British pound continues to go higher. The FOMC statement during the trading session on Wednesday could send this pair higher due to the fact that the Federal Reserve may start talking about further loosening monetary policy. Because of this, we are setting up for a nice bounce higher, but I also recognize that the FOMC could throw a massive monkey wrench into the scenario if they say the wrong things.

All things being equal, if we were to break higher and it’s likely that the market will go looking towards the 1.3150 level, possibly even the 1.3250 level after that. At this point, the market seems to be gravitating towards the 50 day EMA, as the top of the candlestick for the trading session on Tuesday has tested. Having said that, we should continue to see plenty of buying opportunities on dips, and although I am very bullish of this market it seems to be unlikely that we are simply going to be able to take off.