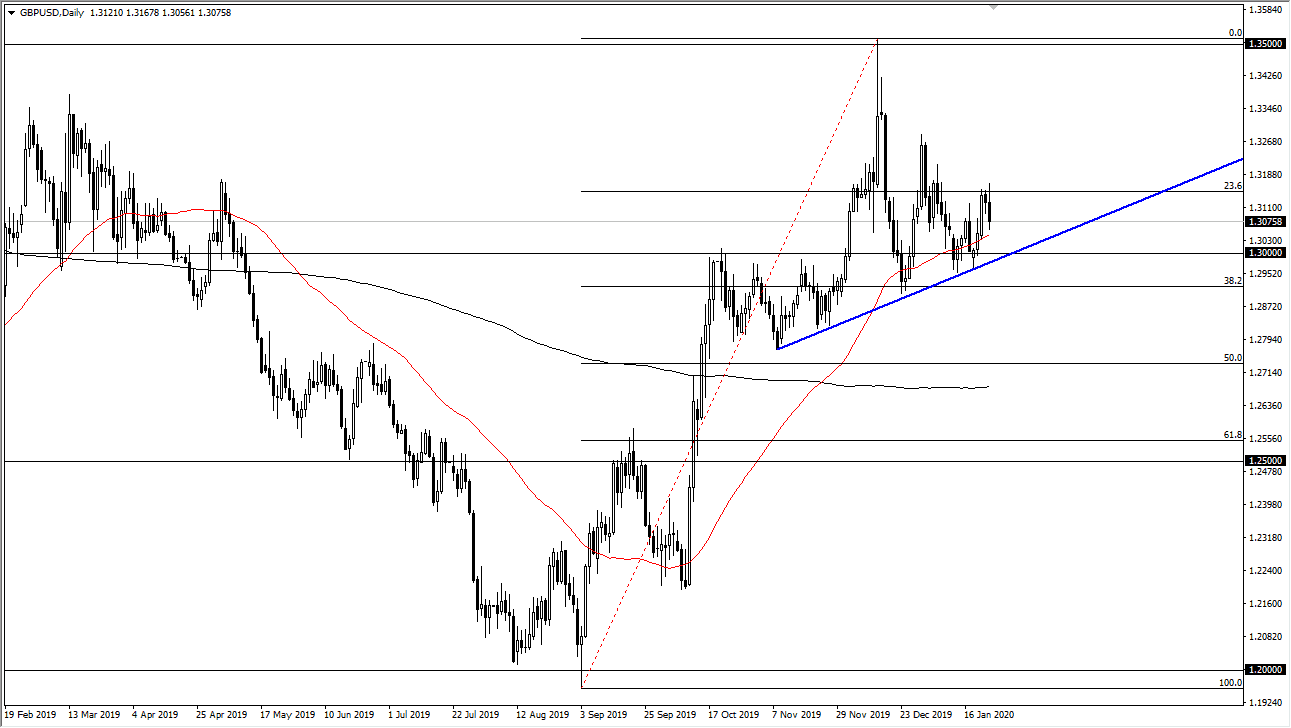

The British pound initially tried to rally during the trading session on Friday, breaking above the highs of the hammer from the previous session. However, we have turned around to break through the bottom of that hammer to turn it into a “hanging man.” The 50 day EMA underneath should be a supportive level, and therefore buyers could come back into play. The uptrend line underneath will continue to be supportive, and I think it should be paid attention to. Until we break down below that level, I have no interest in trying to short this market, as we have seen a resilient pattern of buying dips. That being said, we also have the occasional rally that breaks down, so I think at this point it’s likely that we will continue to see more of the same pattern. That being said though, we have clearly seen a move higher over the last several months and therefore as long as we can stay above this trendline I feel more comfortable buying than selling.

If we do break down below the trendline, then it’s possible we could get a move down to the 1.28 level, but that seems to be very unlikely in the short term. However, if we do turn around and see some type of bounce as I anticipate, we will probably continue to try to grind towards 1.35 handle. Remember, there is a Bank of England industry decision at the end of the year, but we continue to see economic figures such as employment and PMI out of Great Britain do better than anticipated, perhaps putting the idea of a rate cut on hold. If that’s going to be the case, then it should be good for the British pound in general. Furthermore, the market seems to be coming to grips with the idea that we are going to finally see Brexit happen, and therefore the worst is over.

To the upside, I believe that the 1.35 level will continue to be resistance and a potential target so pay attention to that level. If we were to break above, there it would be a very bullish sign but right now I think we have a lot of work to do before we can contemplate that. Short-term pullbacks continue to be buying opportunities, and therefore that’s how I have been trading this market and will continue to do so.