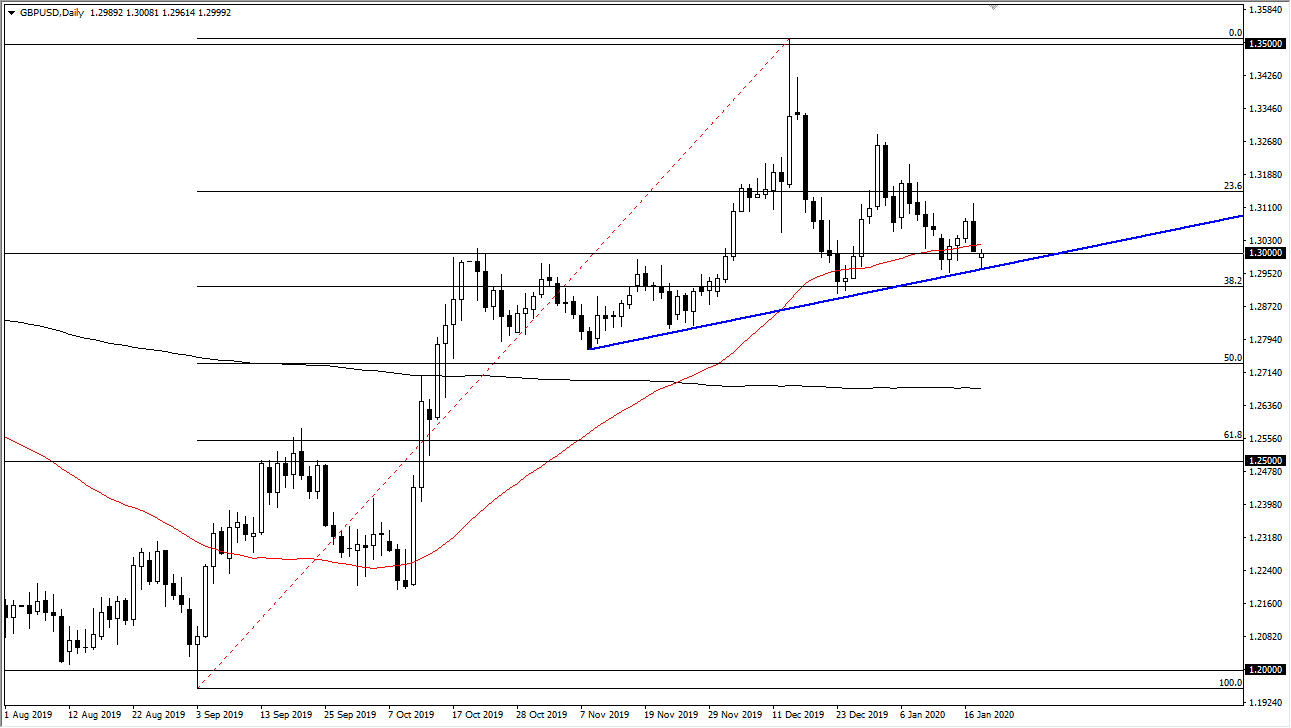

The British pound initially fell during the trading session on Monday, breaking well below the 1.30 level. That being said, we have seen a nice bounce to turn around and form a bit of a hammer. The uptrend line has remained intact, and as a result it’s likely that the market will continue to try to grind to the upside. The hammer that has formed of course is a good sign, as it is on top of the trend line, coinciding nicely with a large, round, psychologically significant figure, and furthermore the 50 day EMA.

If we were to break above the 50 day EMA, it’s very likely that the market within go looking towards the top of the Friday session. If we were to break above the top of the Friday session, then it’s likely that the market will shoot straight up in the air based upon a break of major resistance. The market has been very choppy for some time now, and the Friday candlestick of course was very negative due to the retail sales in the United Kingdom being horrific. That has traders out there starting to think about the possibility that the Bank of England cuts rates, and that of course is negative for the currency in general. At this point, traders are going to see whether or not the BOE has to cut rates after the meeting later this month.

This is a market that remains very volatile, but quite frankly that should not be surprising considering that not only the retail sales, but the possibility that Brexit will continue to cause major issues. With this, it’s likely that we will continue to see a lot of volatility, but it is probably only a matter of time before we have to make some type of decision at as a market. A break above the 50 day EMA is a very bullish sign, just as a break down below the hammer from the trading session on Monday would be negative. At this point, then the market would probably go looking towards 1.28 handle, and then possibly the 1.27 level after that as it would go looking towards the 200 day EMA. Expect choppy volatility, but it is probably only a matter of time before an impulsive candlestick forms, pointing the market in the right direction for a bigger move. Once the market makes a bigger candlestick in one direction or the other, I’m willing to follow it.