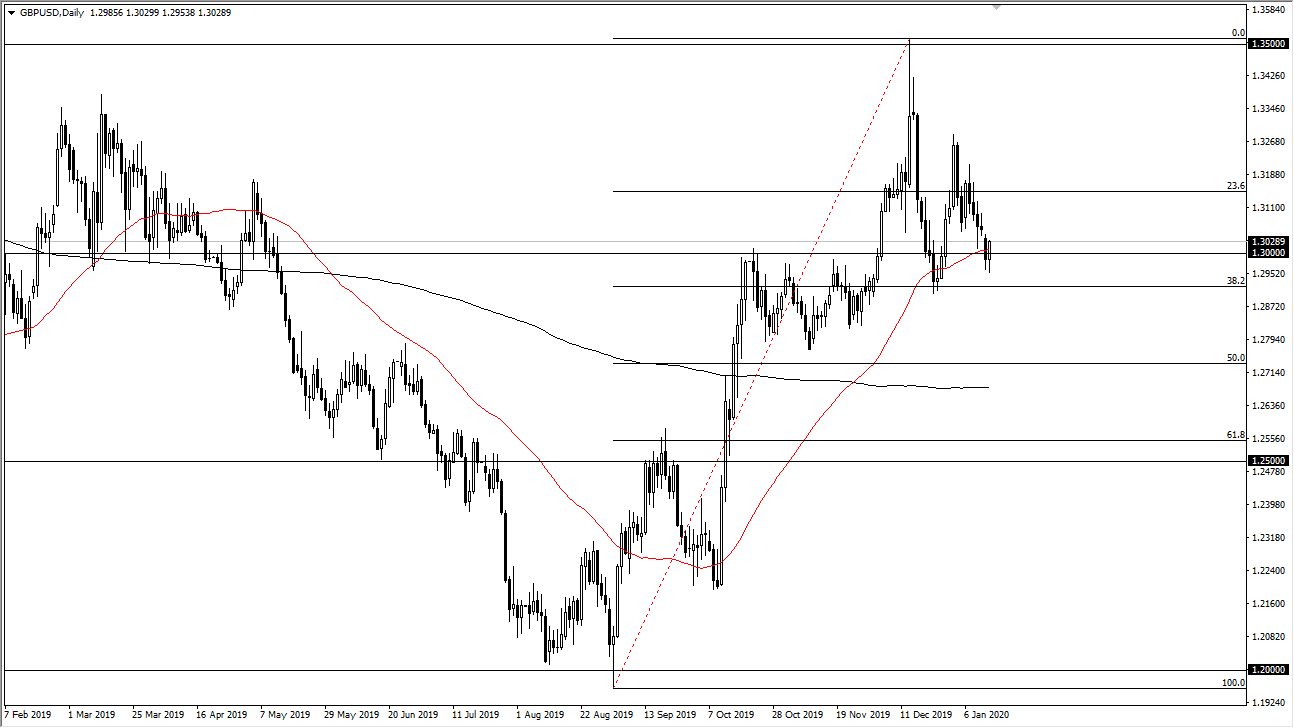

The British pound rallied after initially falling during the trading session on Tuesday, as we continue to see a lot of life pumped into Sterling regardless. That being the case, it’s very likely that we will continue to see upward momentum, as the 1.30 level has offered a psychologically important figure, as well as the top of the previous bullish flag that kicked off the most recent rally to begin with.

That being the case, the market is also paying attention to the 50 day EMA which is right here in this area, and it looks very likely that the market is going to continue to consolidate in this area, perhaps trying to build a bit of a triangle. A triangle of course could be a sign that the market is trying to build up enough momentum to finally make a bigger move. The 1.35 level above is considered to be a bit of a “ceiling”, but I also think that based upon the flag that had been produced previously measuring to the 1.38 level is something that should be paid attention to as well. Longer-term, I think that the British pound is still considered to be “cheap” and therefore that’s how this pair will trade. Yes, the Bank of England is likely to continue to be dovish, but that is a “known known.”

This doesn’t mean that the market is going to be able to go straight up in the air without some type of volatility, far from it. In fact, I think that short-term pullbacks will continue to offer a bit of a buying opportunity, although I do recognize there is a minor gap above. Once that gets broken through, I suspect that there are people willing to jump in at that point as well, as it would show an impulsive move to the upside. To the downside, it appears that the bullish flag that had previously been such a huge factor on this chart will offer support, meaning that the support extends all the way down to the 1.28 level underneath. The British pound continues to recover after the Brexit vote, as we stay the course to getting out of the European Union going forward. The more that the market sees as a unified British government, the more likely this pair is to continue going higher. Furthermore, the US dollar is softening a bit against several other currencies as well, having a bit of a “knock on effect” over here.